The world’s largest cryptocurrency Bitcoin (BTC) continues to face strong selling pressure and might soon enter a major correction ahead.

Over the last 48 hours, a lot of things have been happening in the Bitcoin ecosystem with BTC gas fees skyrocketing to new highs and resulting in all the drama with crypto exchange Binance suspending withdrawals twice on Sunday.

There have been speculations that the Bitcoin Ordinals, with the BRC20 standard, have been driving the gas fee higher. However, this has resulted in strong selling pressure on Bitcoin which has dropped another 2% moving under $28,000 and is currently trading at $27,652 with a market cap of $535 billion.

Although the surge in the gas fee is a pretty good sign for Bitcoin miners, investors need to be watchful of some red flags ahead. Popular crypto handle WhaleWire explains:

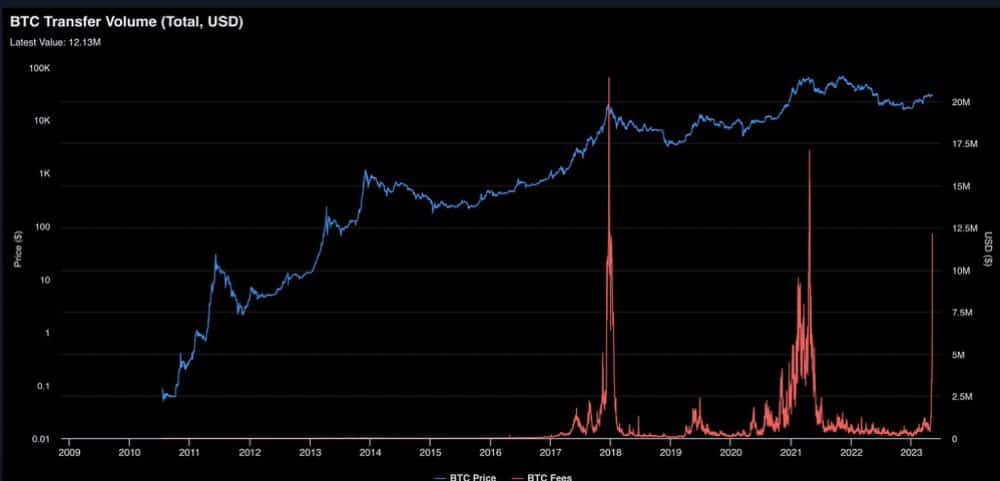

Bitcoin transaction fees have surged to its 3rd highest level in history. The last two times, we witnessed the peaks. At 20K in 2017, and 68K in 2021. $BTC price corrected by over 80% following the prior fee surges + congestions. Are we in for a repeat?

Furthermore, on the technical chart, Bitcoin has formed a classic head and shoulders pattern. Thus, any dip further could straight away push the Bitcoin price to $24,000 as the next immediate support.

Bitcoin has formed a textbook head and shoulders pattern

A confirmed breakdown will have an implied target near the $24k region pic.twitter.com/pCVIYASXuf

— Game of Trades (@GameofTrades_) May 8, 2023

The Pros and Cons for Bitcoin Ahead

Although the transaction activity on the Bitcoin blockchain surged massively over the last few days, the total number of active addresses has dropped significantly. New addresses are at their lowest since the beginning of 2023 while active addresses are at their 1-year lows.

Addresses on #Bitcoin have taken an extreme dive; new and active addresses are approaching the 365-DMA.

New addresses are at YTD lows, while active addresses are at 1-year lows.

Despite record transaction levels. pic.twitter.com/ZICWoDMGPJ— James V. Straten (@jimmyvs24) May 8, 2023

The positive side is that the BTC supply at the exchanges is now at its lowest since 2017. A greater exchange supply could lead to major selling pressure. However, a drop in exchange supply hints that investors are moving their BTC into cold custody and are willing to hold for a long time.

📉 The amount of #Bitcoin on exchanges is now at its lowest ratio since December, 2017. The five and a half year low is a good sign of increased interest in self custody for traders, and less potentially at risk to be sold back to exchange wallets. 👍 https://t.co/U3n9McxcnH pic.twitter.com/8NjZLf0k2D

— Santiment (@santimentfeed) May 8, 2023

At the same time, Bitcoin whale activity has also been growing. On-chain data provider Glassnode explains: “One of #Bitcoin‘s largest whale addresses, a #Binance cold wallet, has been extremely active today. Through 4 transactions, this wallet has moved $2.26B worth of $BTC out of its possession. Bitcoin’s supply on exchanges has dropped from 6.78% to 5.84%”.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.