Bitcoin hit a one-year high of $31,400, a price last seen before the May 2022 Terra-LUNA crisis that collapsed and started a set of troubles for the crypto market. Notable analysts and experts predict an upcoming BTC price rally, Bloomberg Intelligence’s senior strategist Mike McGlone warns of many headwinds for Bitcoin price to hit $40,000.

Mike McGlone Predicts If Bitcoin Price To Hit $20,000 or $40,000

Bloomberg Intelligence’s senior strategist Mike McGlone took to Twitter to share the contents of a crypto outlook report. He argues that the launch of several Bitcoin ETFs including BlackRock spot Bitcoin ETF will not shield Bitcoin from facing its first US recession, potential equity bear market, and hawkish central banks.

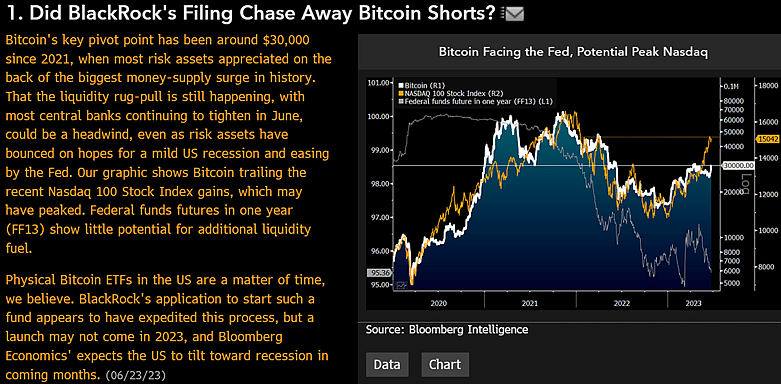

The near-term outlook for Bitcoin is positive, but the key pivot point remained near $30,000 since 2021 amid the biggest money supply surge in history. He highlighted several obstacles that could potentially prevent BTC price from reaching $40,000.

In response to the recent Bitcoin ETF-inspired rally, McGlone said “Physical Bitcoin ETFs in the US are a matter of time, we believe. BlackRock’s application to start such a fund appears to have expedited this process, but a launch may not come in 2023, and Bloomberg Economics expects the US to tilt toward recession in coming months.”

Moreover, he believes the US Federal Reserve continuing interest rate hikes this year, weak US dollar liquidity, and Nasdaq 100 stock index reaching its peak are major obstacles to the upcoming Bitcoin rally.

“That the liquidity rug-pull is still happening, with most central banks continuing to tighten in June, could be a headwind, even as risk assets have bounced on hopes for a mild US recession and easing by the Fed.”

Also Read: Crypto Telegram Channels List 2023; Updated List

Cubic Analytics founder Caleb Franzen largely echoed McGlone’s analytics and highlighted the major zone of resistance for Bitcoin between $31,000 and $35,000.

This is the next key grapple zone for #Bitcoin based on price structure over the past two years. I have to lean bullish going into this red zone, but we must acknowledge the threat of potential resistance here.

Probably best not to chase here, so just sit back & enjoy the show. pic.twitter.com/TdxYvV3K9r

— Caleb Franzen (@CalebFranzen) June 23, 2023

CoinGape Media also reported that the Bitcoin CME gap between $34455 and $35180 is about to get filled. Moreover, over 145k BTC options with a notional value of $4.5 billion are about to expire on Friday, June 30, but analysts remain bullish on BTC price due to overall near-term technical advantage.

Read More: Will Bitcoin Price Fill CME Gap At $34K-$35K? $BTC Options Worth $4.5 B Set To Expire On June 30

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.