Bitcoin price, although not climbing the ladder to the coveted $38,000 resistance level, it is sustaining its position above $30,000. Bulls seem to be at ease, with consolidation allowed to take precedence ahead of an anticipated breakout above the 12-month high of $31,428, according to price data as tracked by CoinGape.

As reported in the previous analysis, Bitcoin price only needs to uphold the position above $30,000 this week to allow for more buyers to join the bandwagon, thus creating enough momentum to settle scores with the seller congestion in the region between $31,000 and $32,000.

Bitcoin price has, in the last 24 hours, gained only 0.6% while boasting a 13% uptick over the last week. With the BTC dominance continuing to grow such that it stands at $590 billion, up from $303 billion just after the FTX-triggered crash in November, the market outlook will probably stay substantially bullish in the short term.

Bitcoin Price Could Experience Turbulence Before Lifting to $38,000

Despite the calmness currently experienced in the crypto market, in a recent commentary shared with CoinDesk, Deribit’s Chief Risk Officer, Shaun Fernando, shed light on the ‘max pain’ threshold for Bitcoin.

This is a critical market juncture that could inflict the greatest financial damage on option holders while concurrently offering the possibility of maximum earnings to option sellers.

Fernando pointed out that this threshold currently lies at a Bitcoin price point of $26,000. He posited that achieving this price level would likely mitigate some of the downward pressure on Bitcoin following the impending options expiration.

“With an impressive open interest of over $350 million at the 30k strike, the approaching quarterly expiration promises an exhilarating conclusion, carrying the potential for price turbulence amidst diverse gamma hedging strategies,” Fernando explained in the written statement.

Navigating The Next Few Days to Make The Most Out of Bitcoin Price Bullish Outlook

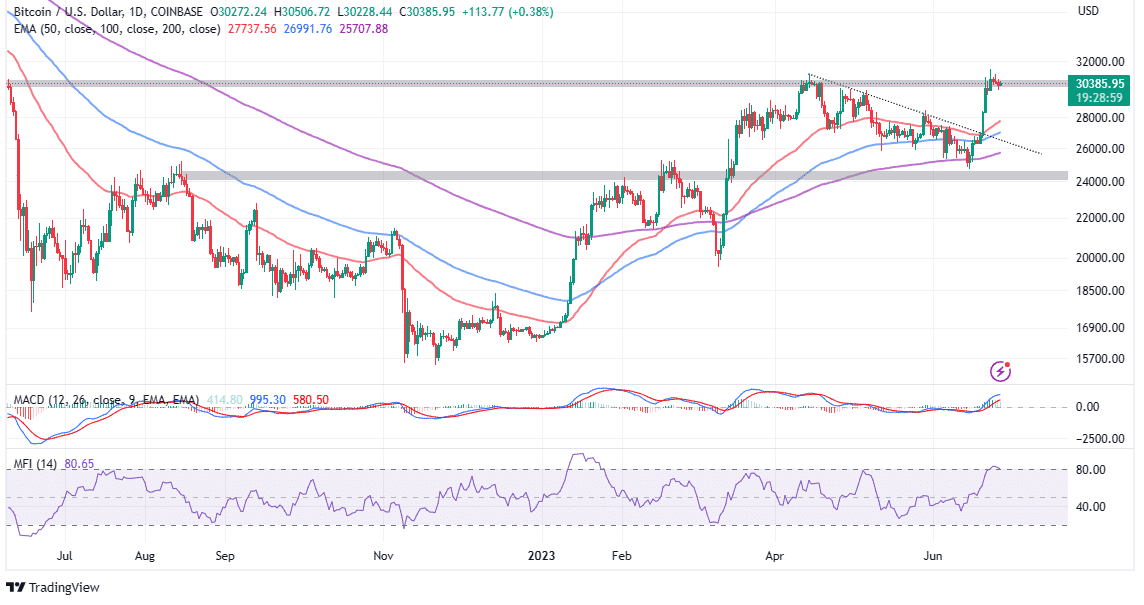

Bitcoin price upholds the uptrend thanks to a buy signal from the Moving Average Convergence Divergence (MACD) indicator. If support at $30,000 is defended at all costs, BTC will keep calling more investors – both retail and institutional to board the ship before it sails too far.

In the event the MACD line in blue stays above the signal line in red, the odds will continue leaning on the bullish side. Moreover, BTC’s position above all the applied moving averages, including the 50-day EMA (red), the 100-day EMA (blue), and the 200-day EMA (purple), reinforces the improving bullish grip.

Investors would still need to be cautious despite BTC’s ongoing consolidation above $30,000. This warning follows the Relative Strength Index (RSI) retracement from the overbought region into the neutral area.

If this pullback becomes consistent, it might call for new approaches to avoid getting caught in a bull trap market situation, where sudden declines below $30,000 could swing to $25,000.

Related Articles

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.