Bitcoin price is closing in on 2023 highs as market sentiment improves across the board. The last couple of weeks have been particularly interesting with BTC falling below $25,000 and promptly reversing the trend to $30,820.

Mid-last week’s remarks by Jerome Powell, the US Federal Reserve Chair, did not sit well with investors. Beyond pausing the long-standing interest rate hikes for the first time since March 2022, Powell said that the bank is inclining toward a “watch and see” approach.

This means that we could see more rate hikes as the battle to bring inflation down to 2% rages on. Investors in risk assets like Bitcoin and crypto were initially discouraged by the remarks but soon started to comprehend the positive short-term sentiments stemming from the pause on rate hikes.

Wall Street’s Love for Crypto Sends Bitcoin Above $30,000

Blackrock, one of the largest companies in the world, spanning many industries shocked the entire world when it filed for a spot Bitcoin ETF last week. Since then, more and more Wall Street firms have been making moves in the industry.

Fidelity Investments in collaboration with Charles Schwab, Citadel Securities, Fidelity Digital AssetsSM, Paradigm, Sequoia Capital, and Virtu Financial launched EDX Markets, a new crypto exchange serving brokers and investors in the digital asset space.

In the latest submission on Wednesday to the Securities and Exchange Commission (SEC), Valkyrie Funds – an entity already managing a Bitcoin Strategy ETF and a Bitcoin Miners ETF – revealed its intent to establish a spot Bitcoin exchange-traded fund.

The ETF, dubbed the Valkyrie Bitcoin Fund, will harbor bitcoin, mirroring the performance of the CME CF Bitcoin Reference Rate, New York Variant. It aspires to make its shares available on the Nasdaq exchange under the ticker BRRR.

However, the SEC hasn’t given its nod to a spot Bitcoin ETF yet. In the previous week, WisdomTree, Invesco, and BlackRock each made filings for their own spot Bitcoin funds.

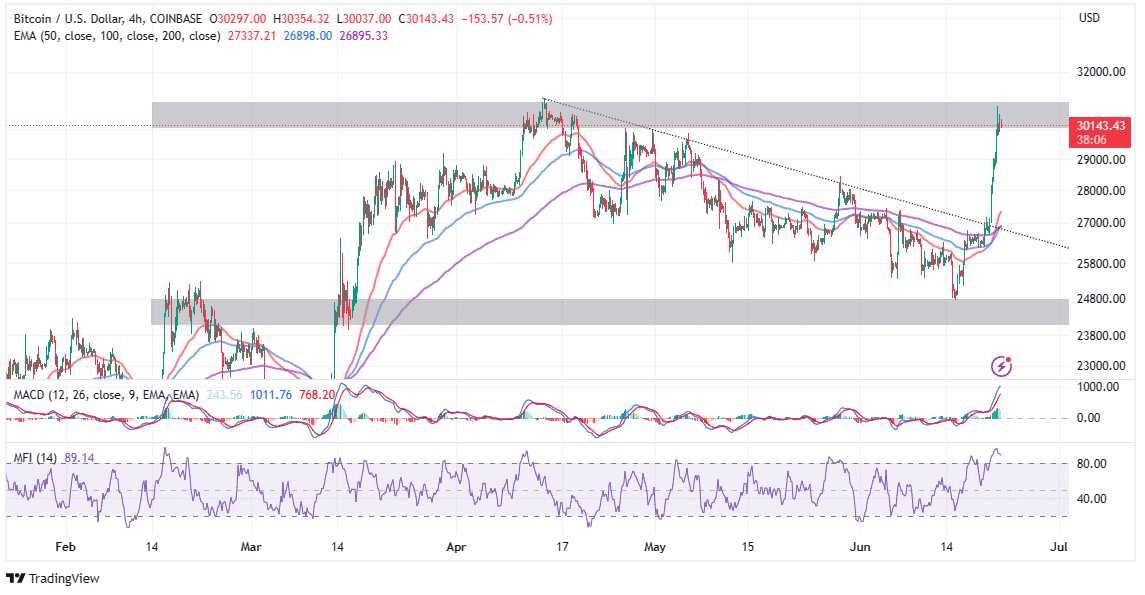

As optimism builds for a possible spot Bitcoin ETF in the US, BTC price has made tremendous progress, breaking above resistance at $28,000 and $30,000. Based on the daily chart, the uptick, which appears to have slowed down due to resistance around the $31,000 area, was bolstered by increased interest from both retail and crypto whale investors.

Bitcoin Price Eyes Consolidation Before Extending Breakout

The largest cryptocurrency’s climb above $30,000 faces mounting resistance at $31,000. This could call for a consolidation period in the range between $29,000 and $31,000. A massive pullback is unlikely based on improving market sentiment and demand for BTC from both retail and institutional investors.

Michaël van de Poppe, a renowned analyst and trader believes as Bitcoin dominance approaches the point of resistance, it would allow the price to consolidate. At the same time, this will ensure altcoins “have some period of relief” where they “can pick up pace.”

#Bitcoin dominance approaching next point of resistance, while #Bitcoin reaches the next point of resistance as well.

Probably #Bitcoin will start to consolidate, so #Altcoins have some period of relief approaching and can pick up pace. pic.twitter.com/5oxf75gorA

— Michaël van de Poppe (@CryptoMichNL) June 22, 2023

That said investors should carefully watch out for Bitcoin price movement when testing support at $29,000 and resistance at $31,000. A break above $31,000 could validate the next rally to $38,000. On the flip side, sliding below $29,000 would strain the support at $28,000 and risk a bigger drop to $25,000.

Related Articles

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.