The world’s largest cryptocurrency Bitcoin (BTC) has recently been under some selling pressure after facing a rejection at $30,000. As of press time, Bitcoin (BTC) is trading at $27,054 and has a market cap of $524 billion.

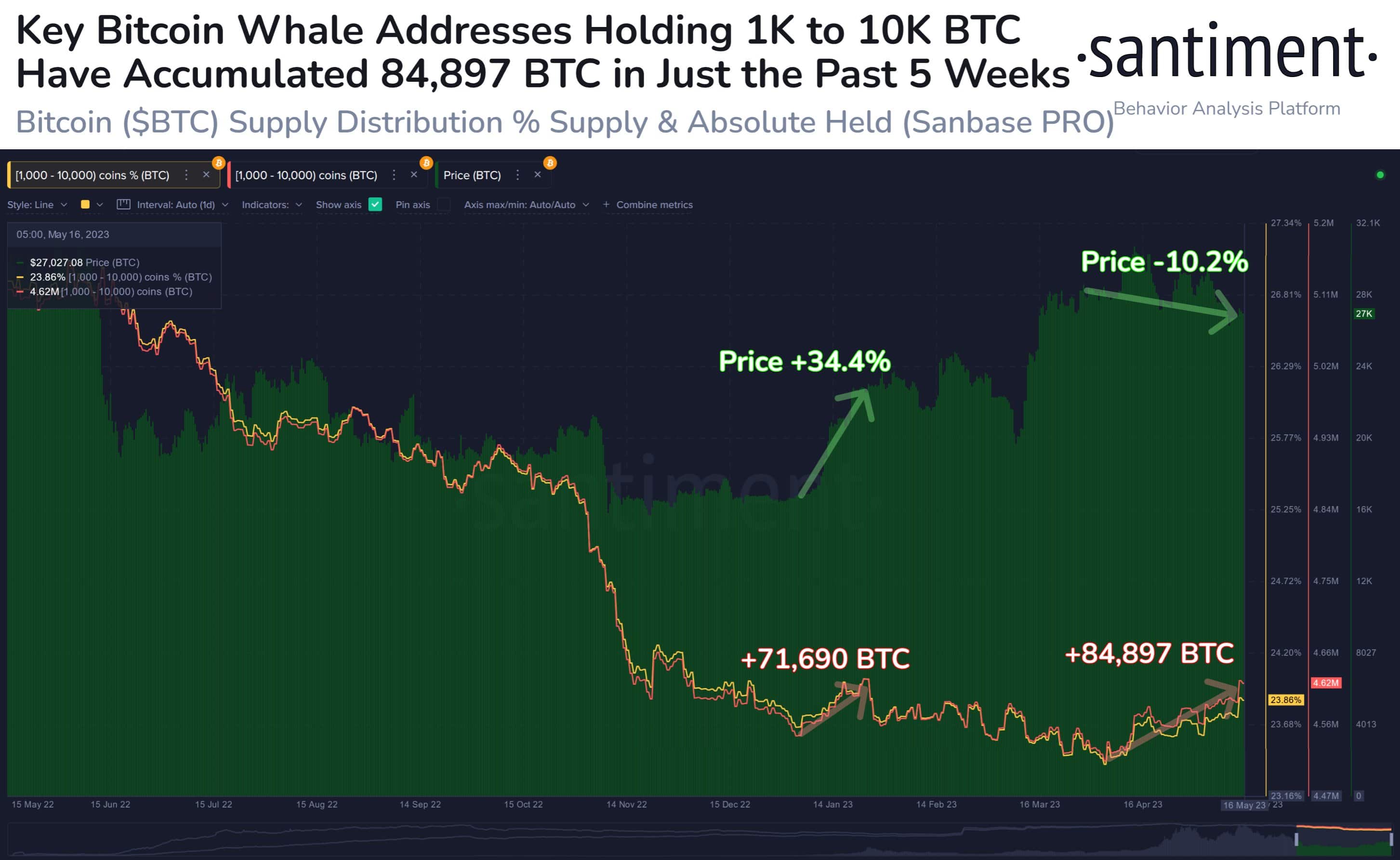

Despite this, Bitcoin key whale addresses have been accumulating at a steady rate over the last five weeks. As per on-chain data provided by Santiment, Bitcoin whale addresses holding between 1K to 10K BTC have accumulated ~85,000 Bitcoins over the past few weeks. In the latest report, it notes:

Bitcoin’s key large whale addresses tier has been on a steady accumulation run over the past 5 weeks, accumulating a combined 84,897 $BTC during this time while prices are stagnant. In their previous accumulation cycle in January, prices jumped +34.4%.

On the other hand, a large number of Bitcoins have been moving off exchanges which could serve as a catalyst to drive Bitcoin prices higher. Popular crypto analyst Ali Martinez noted that more than 20,000 Bitcoins have moved off the exchanges over the last 24 hours.

#Bitcoin | On-chain data from @santimentfeed shows that over 20,000 $BTC have been taken off known #crypto exchange wallets in the past 24 hours. pic.twitter.com/WwL7cGnzPp

— Ali (@ali_charts) May 16, 2023

Where’s Bitcoin Moving Next?

The biggest concern for investors is that where is Bitcoin (BTC) from here onwards. On the upside, Bitcoin should cross 200 MA or EMA i.e. $27,600 after which the BTC price can rally further all the way to $38,000 to $42,000, says crypto analyst Michael van de Poppe.

However, as we see, Bitcoin continues to face some selling pressure off lately. Explaining the support levels, Poppe said:

Sigh, #Bitcoin is again chopperino. Rejects at first resistance point, has a must-hold zone between $26,800-27,000. If that’s lost, we’ll probably cascade towards

While Bitcoin has entered into a consolidation phase, some altcoins have been showing strong moves. Litecoin surged past $90 amid upcoming halving event and boost in LTC20 address activity.

Similarly, Ripple’s XRP is up by 7.5% today as Ripple registers another micro win with judge Torres denying SEC’s motion to seal the Hinman Documents.

Another win for transparency! Unredacted Hinman emails to be publicly available soon – stay tuned as the lawyers work through the mechanics to make that happen. https://t.co/o6puPypRHd https://t.co/qmaLVeQaP8

— Brad Garlinghouse (@bgarlinghouse) May 16, 2023

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.