- The technical analyst CryptoCon believes that it is only a matter of time before BTC starts to “take off.”

- At press time, BTC’s price had printed a slight 24-hour gain – taking its price to back above $27K.

- BTC may look to flip the $27.3K resistance into support in the next 24-48 hours.

CryptoCon, a technical analyst, tweeted yesterday that it is only a matter of time before Bitcoin (BTC) starts to take off. The post was made after the Pi Cycle Top indicator started to bullishly retest the 111 daily moving average, which the analyst noted as a very important technical flag.

At press time, CoinMarketCap indicated that the market leader’s price stood at $27,063.83 after it printed a 0.65% gain over the previous 24 hours. This daily gain had also added to BTC’s weekly gain – taking the total to +0.78%.

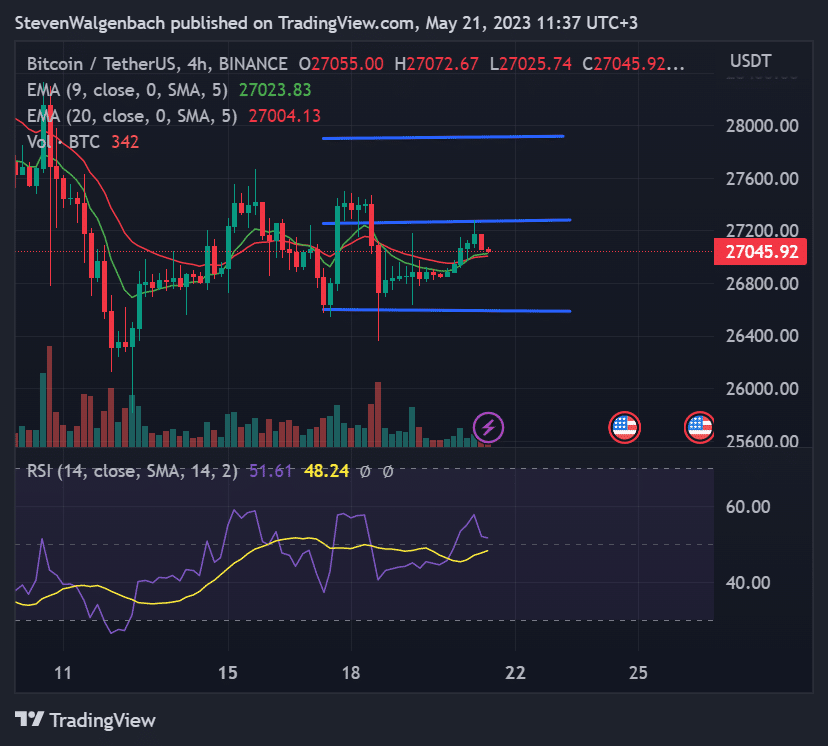

BTC’s price was trading above the 9 EMA and 20 EMA lines on its 4-hour chart at press time. Technical indicators suggested that the market leader’s price may not maintain a position above these 2 EMA lines for the remainder of today’s trading session, however.

The RSI line on BTC’s 4-hour chart was bearishly sloped towards oversold territory and the 9 EMA line was on the cusp of crossing bearishly below the 20 EMA line. Should BTC’s price drop below the two previously-mentioned EMA lines, it will drop to the next key support level at $26,587 in the following week.

An early confirmation of this bearish thesis being validated will be the RSI line on the 4-hour chart crossing below the RSI SMA line. On the other hand, if BTC is able to close today’s trading session above the 9 EMA and 20 EMA lines on the 4-hour chart, it may look to challenge the $27,300 resistance to flip the level into support in the next 24-48 hours.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.