According to a recent projection made by global asset management firm Bernstein, Bitcoin (BTC) price is expected to reach $150,000 levels in the 2024 to 2027 cycle.

Bitcoin (BTC) Price to See 336% Jump

Within the past 24 hours, Bitcoin has seen a minute price gain of 0.5% and the leading cryptocurrency is currently trading at $34,530.02. However, Bernstein is bullish about the coin. To hit the huge price jump projected by the asset manager, BTC would be required to surge by up to 336% from its present market value.

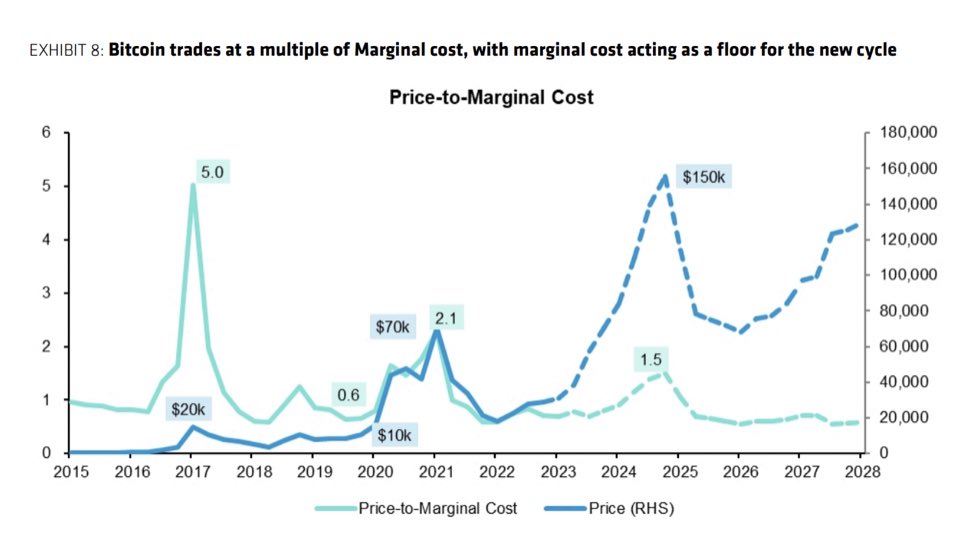

To buttress its claim, Bernstein recalled a historical relationship between Bitcoin price and its price-to-marginal cost. This comparison is important in demonstrating how far BTC trades above its production cost. In the long run, this provides miners with the necessary insights into potential profitability as well as the sentiment of the broad market.

It is worth noting that the Bitcoin (BTC) price was about 5 times its marginal cost six years ago. Markedly, this registered an All-Time High (ATH) of approximately $20,000 for the coin at the time. Two years later in 2019, the coin peaked but not as high as the figure recorded in 2017. The 2019 peak saw a 1.5 multiplier that made it almost hit a price tag of $70,000.

The projection by Bernstein will be achieved with an anticipated price multiplier of 1.5, as this is the most plausible way to achieve the aforementioned potential price of $150,000 by mid-2025. Many times, marginal cost serves as a support level or floor for the token price and this is seen in the valleys in the chart. Precisely, it shows that Bitcoin price rarely goes below the marginal cost.

Bitcoin ETF Approval Can Trigger Price Run

In addition, the prospects of a spot Bitcoin ETF approval from the United States Securities and Exchange Commission (SEC) are believed to hold greater value for the asset in the long run.

Analysts across the board appear to have strongly agreed that the SEC’s approval for the ETF could pump Bitcoin (BTC) price to $45,000 before the end of 2023. The conversation concerning the potential approval of Bitcoin ETF is changing and rather than the uncertainty from earlier in the year, experts are now giving permutations as to when the product will finally be approved.

Applicants like BlackRock and Valkyrie have already seeded their Bitcoin ETFs, a move many believe takes the applications closer to the anticipated approval.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

✓ Share: