- Tether is becoming the most secure asset in the crypto world, as per Reuters.

- Investors are shifting focus towards secure tokens amid US banking crisis shared the news platform.

- Tether’s market value has significantly increased and is backed by a dollar reserve.

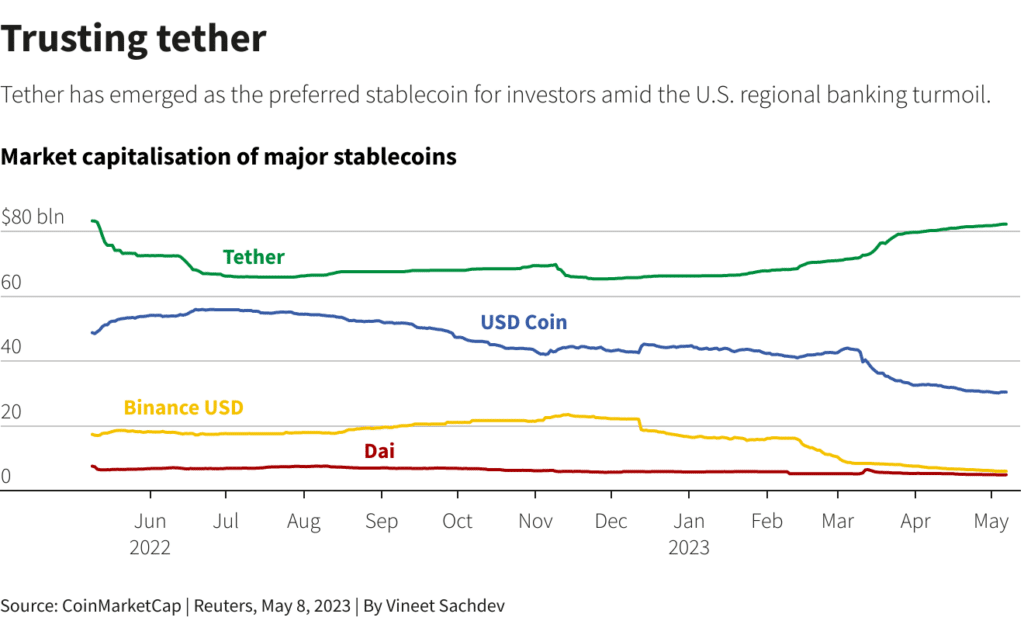

Tether, a digital stablecoin, is emerging as the most secure asset in the world of cryptocurrency, reported Reuters. According to the news publication, amid a growing banking crisis in the United States and increased regulatory scrutiny on cryptocurrency companies, investors in the crypto sphere are shifting their focus towards tokens and coins that are considered relatively secure.

Since March, Tether, which is a stablecoin tied to a fiat currency such as the US dollar, has emerged as the best-performing stablecoin with its market value experiencing a significant increase.

Moreover, Tether’s value is backed by a reserve of dollars and has a fixed supply of approximately 85 billion tokens, maintaining a 1-to-1 peg with the US dollar. Due to high demand, the coin’s value has remained above 1 since mid-April, reaching 1.002 last week.

Anders Kvamme Jensen, the founder of the AKJ global brokerage based in Oslo, stated,

The banking crisis is fuelling ‘hyper-bitcoinisation’ – the inevitable endgame that the dollar will be worthless.

Jensen added that this has resulted in a surge of investors moving towards leading cryptocurrencies such as Bitcoin and Ether.

Stablecoins like Tether are considered a store of value and a tool for transferring funds between cryptocurrencies and are also used as collateral for derivative trades. Tether’s premium price is due to the growing trust in its peg and safety from SEC scrutiny.

Meanwhile, Tether’s competitor, USDC, has suffered losses from its exposure to a collapsed bank and regulatory pressure on fintech and crypto firms. Tether is owned by iFinex Inc and is viewed as less US-focused, thereby reducing regulatory risks.

Additionally, it has become the third-largest token on CoinMarketCap, with a market cap of $82 billion and a share of 6.83%.