- Messari, a market intelligence page, noted that Polkadot’s cross-chain message format has expanded beyond just asset transfers.

- The number of XCM channels has reportedly seen a 60% increase.

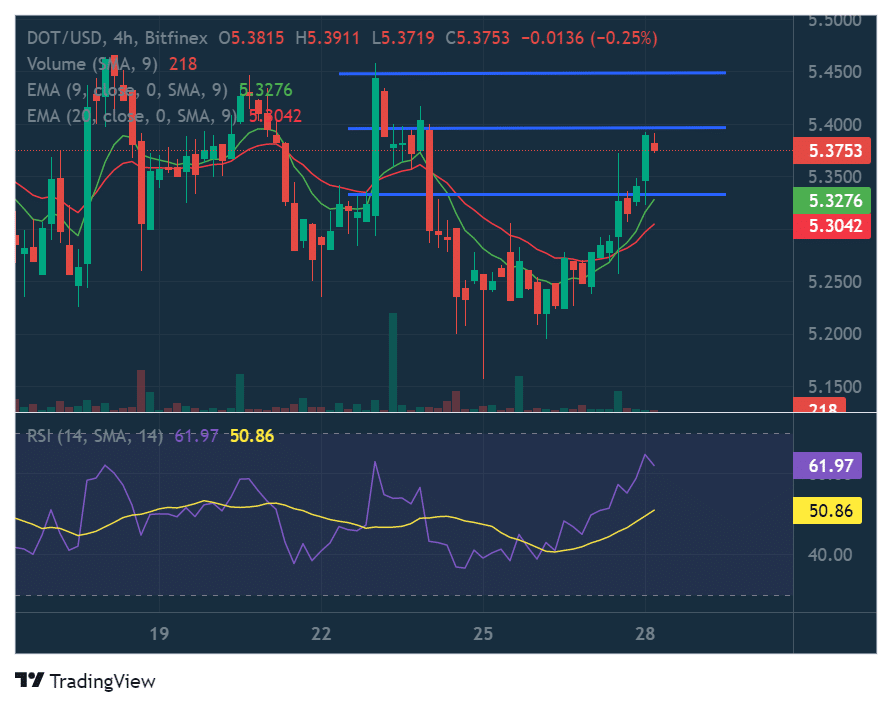

- At press time, DOT was trading at $5.37 after it printed a 1.88% gain over the past 24 hours.

The market intelligence page Messari shared in a tweet published yesterday that the usage of Polkadot(DOT) cross-consensus message format (XCM) has expanded beyond asset transfers. According to the post, the number of XCM channels increased by 60%.

At press time, DOT was changing hands at $5.37 following a 24-hour gain of 1.88% according to CoinMarketCap. Despite the recent increase in DOT’s price, its weekly performance remained in the red at -0.32%.

The altcoin not only strengthened against the dollar over the past 24 hours, but also outperformed the two crypto market leaders Bitcoin (BTC) and Ethereum (ETH) during this time period. At press time, DOT was up 0.06% against BTC and 0.96% against ETH.

DOT’s price had flipped the resistance level at $5.3350 into support over the last 24 hours and had attempted to do the same with the next major resistance obstacle at $5.3951. Bears, however, had stepped in to defend the price mark and introduced some sell pressure to DOT’s charts, as evident by the wick that was present above the latest 4-hour candle.

This selling pressure had resulted in the RSI line establishing a peak, which suggested that DOT’s price would retrace in the following 8 hours. Should this brief correction in the altcoin’s price happen, DOT’s price may drop back down to the recently-flipped level at $5.3350.

DOT’s price dropping to around $5.3350 in the next 24 hours may be seen as a buy entry for traders, which will result in DOT’s price climbing again and possibly breaking above $5.3951 in the following 48 hours. On the other hand, if DOT’s price loses the support of the $5.3350 level, then it is at risk of falling further to $5.2406.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.