- Injective (INJ) was one of the few cryptos trading in the green at press time.

- The altcoin was trading at $7.85 following a 0.28% gain in the past 24 hours.

- Technical indicators suggested that INJ would retest the next key resistance level in the next 48 hours.

Injective (INJ) was one of the few cryptocurrencies that was able to print a gain over the past 24 hours. At press time, the altcoin’s price stood at $7.85 following a 0.28% increase according to CoinMarketCap.

In addition to strengthening against the dollar, INJ also outperformed the two crypto market leaders Bitcoin (BTC) and Ethereum (ETH) over the past 24 hours. At press time, INJ was up 0.41% against BTC and 0.53% against the leading altcoin. As a result, 1 INJ token was worth 0.0002893 BTC and 0.004134 ETH.

The daily trading volume for INJ had dropped, however. At press time, the total volume stood at $44,078,450, which was a 35.20% decrease in the past 24 hours.

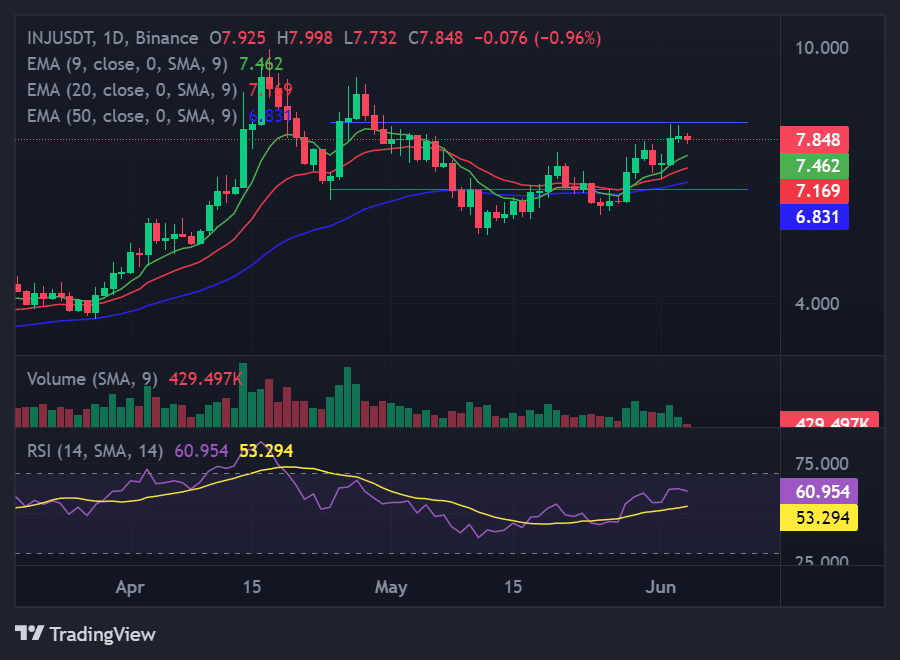

INJ’s price had attempted to break above the key resistance level at $8.25 over the past 24 hours, but bears were able to defend the mark and keep the altcoin’s price below this point at press time. Technical indicators did, however, suggest that INJ would retest the resistance level in the next 24-48 hours.

At press time, the 9-day EMA line was trading above the 20-day and 50-day EMA lines. In addition to this, the 20-day EMA line was trading bullishly above the 50-day EMA line. These technical flags indicated that INJ’s price was in a medium-term bullish cycle and it would continue to rise.

This bullish thesis will be invalidated if INJ’s price drops below the 9-day EMA line in the next 24 hours. Should this happen, the crypto’s price will be at risk of dropping to the next major support level at $6.83 in the following 48 hours, which is the same level as the 50-day EMA line.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.