- Gemini’s Cameron Winklevoss addressed the DCG and Genesis issues in an open letter.

- In the three-page letter, the American investor offered a “final deal” to concerned parties.

- A failure to accept the deal could lead to a lawsuit not just for DCG but also for its founder, Barry Silbert.

Cameron Winklevoss, the co-founder of the Gemini crypto exchange, tweeted, “An Open Letter to Barry Silbert.” The three-page letter addresses the delays caused by Digital Currency Group (DCG) and the now-bankrupt Genesis in finalizing the repayment for the affected individuals.

Also read: Will Bitcoin price face negative effects from Federal Reserve’s two rate hikes?

Winklevoss’ frustration and context

The collapse of Three Arrows Capital, followed by Sam Bankman-Fried’s FTX exchange, caused a huge blow to major institutions involved in the crypto industry. Digital Currency Group-owned lending platform Genesis was one such affected company.

Unable to honor withdrawals, Genesis halted withdrawals on November 16, 2022. On January 19, the institution filed for Chapter 11 bankruptcy protection.

Since then, there has been no plan of action from DCG to repay the affected Earn users, aka Genesis customers.

Barry Silbert faces the Final Offer

After Barry Silbert failed to respond to Cameron Winklevoss’ initial open letter, the second one was much more direct. Winklevoss addresses how Barry Silbert has “engaged in fraudulent behavior” and that the founder’s previous letter addressing the board was a “Master Class in lack of self-awareness.”

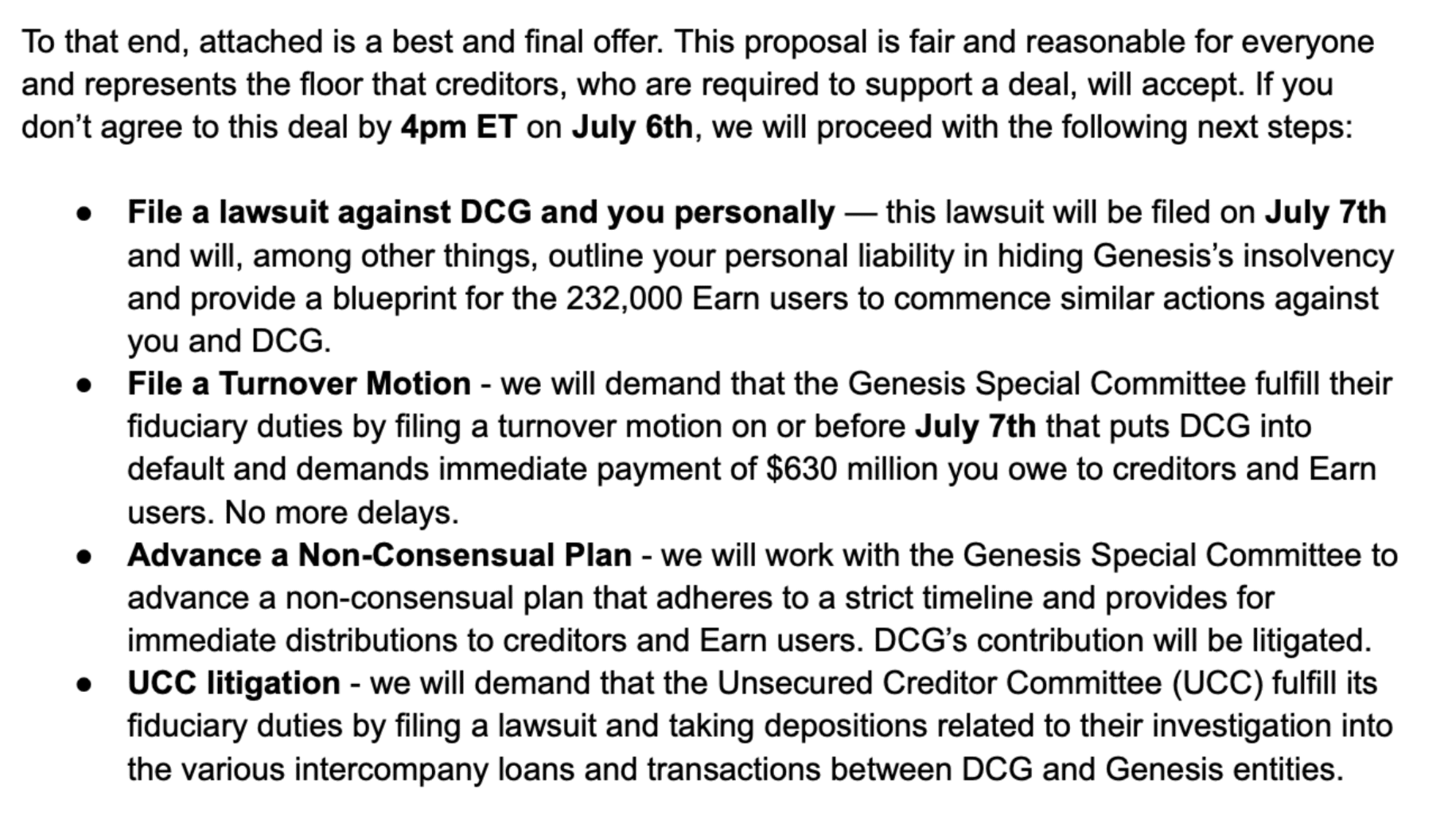

He goes on to “break down” the game for Silbert and proposes a repayment structure to Earn users. The proposed package offers forbearance payments and loans denominated in US Dollars, Bitcoin and Ethereum. As seen in the image below, failing to comply, says Cameron Winklevoss, will lead to a lawsuit against DCG and Barry Silbert among other things.

Cameron Winklevoss’ Open Letter

Related Stories

Gemini files motion to dismiss SEC lawsuit as Genesis bankruptcy drags on

Genesis creditors won’t get full value of their claims, bankrupt crypto lender files updated plan

DCG to close down its institutional trading arm amidst a harsh crypto market

Like this article? Help us with some feedback by answering this survey: