Shortly after the US government said it reached some sort of a deal regarding the debt ceiling, BTC jumped by over a grand to register a three-week high.

The altcoins are also in the green today, with ETH tapping $1,900 for the first time since early May.

BTC Shot Up to Local Peaks

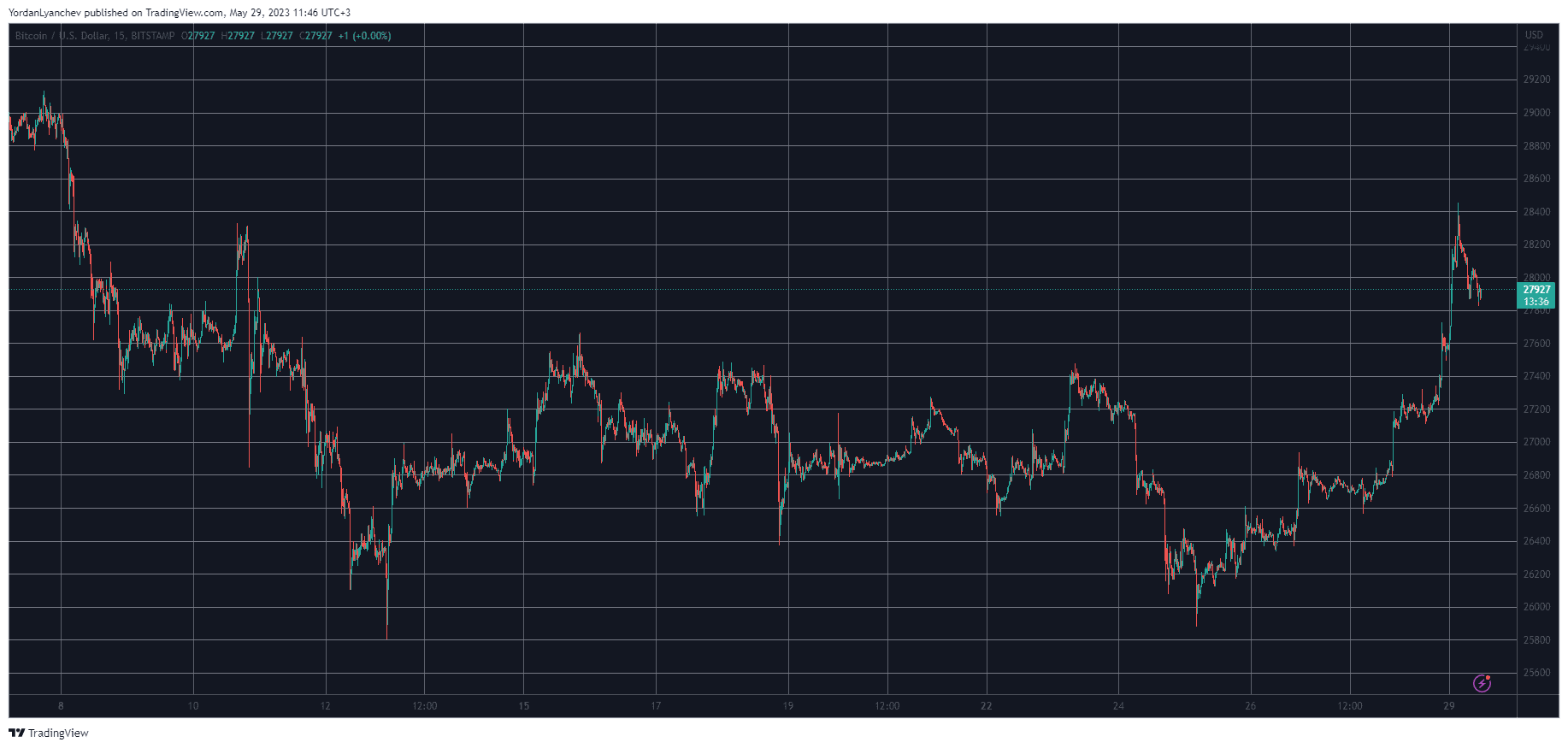

Bitcoin was trading sideways for most of last week, as it was stopped at $27,500 on a few occasions. The last one drove the asset south hard as it dipped to under $26,000 for the first time in two weeks.

After recovering most of the lost value in the next day or so, BTC return to its rather familiar range of $26,500 and $27,500. The start of the weekend was relatively stable as the cryptocurrency remained at around $27,000.

It wasn’t until early Monday when the landscape started to change. On news that the US government had finally struck a deal on the debt limit, BTC jumped by ove a grand and neared $28,500, which became its highest price tag since May 8.

Despite losing several hundred dollars since then, bitcoin is still over 2% up on the day. Its market capitalization has shot up to $540 billion, and its dominance over the alts is up to 46.6%.

ETH Taps $1.9K

The alternative coins have also headed north in the past 24 hours. Ethereum is among the most notable gainers from the top 10. ETH is up by almost 3% and tapped $1,900 to mark its highest price tag in about three weeks.

Binance (2%) is close to $315. Ripple, Cardano, Dogecoin, MATIC, Solana, Polkadot, Litecoin, and Avalanche are also in the green.

The most gains come from LDO and QNT. Both assets are up by somewhere between 5-6%.

Overall, the total crypto market cap exceeded $1.170 trillion earlier today, which mean it had added $30 billion daily and $70 billion in four days.

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

PrimeXBT Special Offer: Use this link to register & enter CRYPTOPOTATO50 code to receive up to $7,000 on your deposits.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Cryptocurrency charts by TradingView.