- Nicholas Merten, a trader and analyst, predicted that the next decade may not be so favorable for the crypto market.

- The trader believes that bonds will offer institutional investors a much better investment opportunity than cryptos in the next decade.

- At press time, BTC traded at $26,742.17 following a 1.99% decrease over the past 24 hours.

Trader and analyst Nicholas Merten uploaded his latest analysis for the crypto market to his channel yesterday. In the video, he stated that the next decade may see less liquidity and growth opportunities flow into the crypto market compared to that witnessed in the previous decade due to a significant macroeconomic event that has recently occurred.

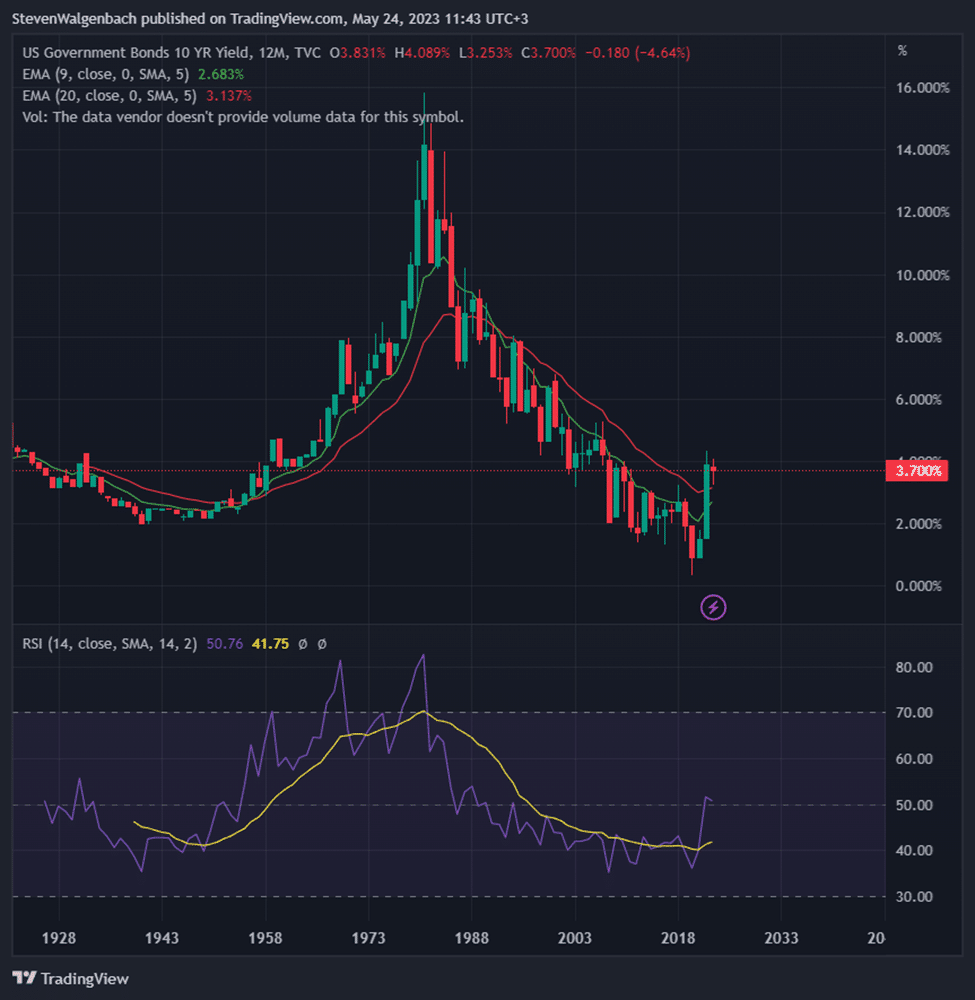

According to Merten, Bitcoin (BTC) is showing signs of weakness as both retail and institutional funds continue to flow out of crypto – drying up liquidity in the overall market. As a result, he predicted that investors may inject their capital into U.S. treasury bonds, given that the U.S. 10-year yield has recently reversed its bearish trend for the first time since 1951.

The trader added that this flip on the U.S. Government 10-year bond chart is problematic for BTC and the rest of the crypto market since bonds offer a guaranteed rate of growth – offering investors a more stable and reliable return on investment than riskier asset classes such as cryptos.

Although retail investors with a higher risk appetite will continue to invest in the crypto market, Merten argued that institutional funds, which he believes are the true drivers of crypto prices, will begin to flow into treasury bonds. One factor that will determine the rate at which institutional funds flow into U.S. treasury bonds will be the rate of inflation, according to the trader.

Should inflation continue, which he believes will happen, then institutional funds will flow a lot quicker into treasury bonds and remain there for the foreseeable future. Nonetheless, the trader did not rule out the possibility of BTC reaching a new ATH, but predicted that it would take several decades without the aid of institutional investors.

At press time, CoinMarketCap indicated that BTC’s price traded at $26,742.17 following a 1.99% decrease over the past 24 hours. This negative daily performance also flipped its weekly performance into the red, which stood at -0.40% as a result.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.