- A report released by CryptoQuant this morning reveals that although BTC has the potential to move up, there are three factors that could prevent this.

- A decline in holdings by US institutional investors and a drop in the total supply of stablecoins are just two of the issues highlighted in the report.

- The absence of new BTC smart money players was also an issue pointed out in the report.

The on-chain analytics platform, CryptoQuant, shared a post on Twitter earlier today regarding Bitcoin (BTC) and what could be in store for the market leader for the rest of the year. The post stated that BTC still has the potential to rise further, but there are many factors that could hinder any upward moves for BTC.

One significant factor affecting BTC’s growth is the decline in holdings by US institutional investors. Historically, during major bull markets, an increase in BTC holdings by US institutional investors has correlated with significant price surges.

However, in recent months, these holdings have been steadily decreasing. According to CryptoQuant, this is likely attributed to institutional investors shifting to global exchanges and decentralized exchanges (DEXs) in response to ongoing crypto market regulations imposed by the Securities and Exchange Commission (SEC).

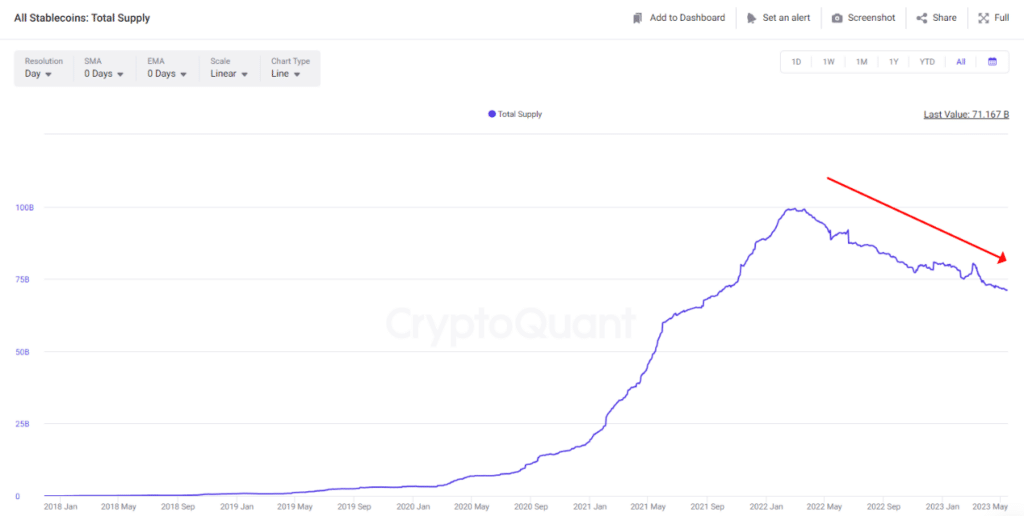

Another factor constraining BTC’s upward momentum is the decrease in the total supply of stablecoins. The total supply of stablecoins can serve as an indicator of buying capacity within the crypto market. After reaching a peak of $99 billion in February 2022, the total supply has diminished to $71.1 billion, implying a decline in overall buying power.

Lastly, CryptoQuant pointed out that the absence of new smart money players also poses a limitation to BTC’s potential move up. The BTC Token Transfer indicator revealed a lack of significant changes, which could suggest that the recent price movement is predominantly driven by supply and demand dynamics rather than the entrance of fresh smart money.

Although BTC demonstrates the potential for further price increases, CryptoQuant predicted that macroeconomic factors such as an anticipated recession in the latter half of this year could instigate asset price crashes. As a result, it is unlikely that BTC will see a continuous ascent as it did back in 2015.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.