While the interest in crypto investments was on the rise last year among home offices, 2023 saw a massive decline in investors’ certainty about the digital assets market.

According to a Goldman Sachs report published on May 8 titled “Eyes on the Horizon: Family Office Investment Insights,” 32% of family offices currently hold investments in digital assets. This category includes cryptocurrencies, nonfungible tokens (NFTs), decentralized finance (DeFi) and blockchain-focused funds.

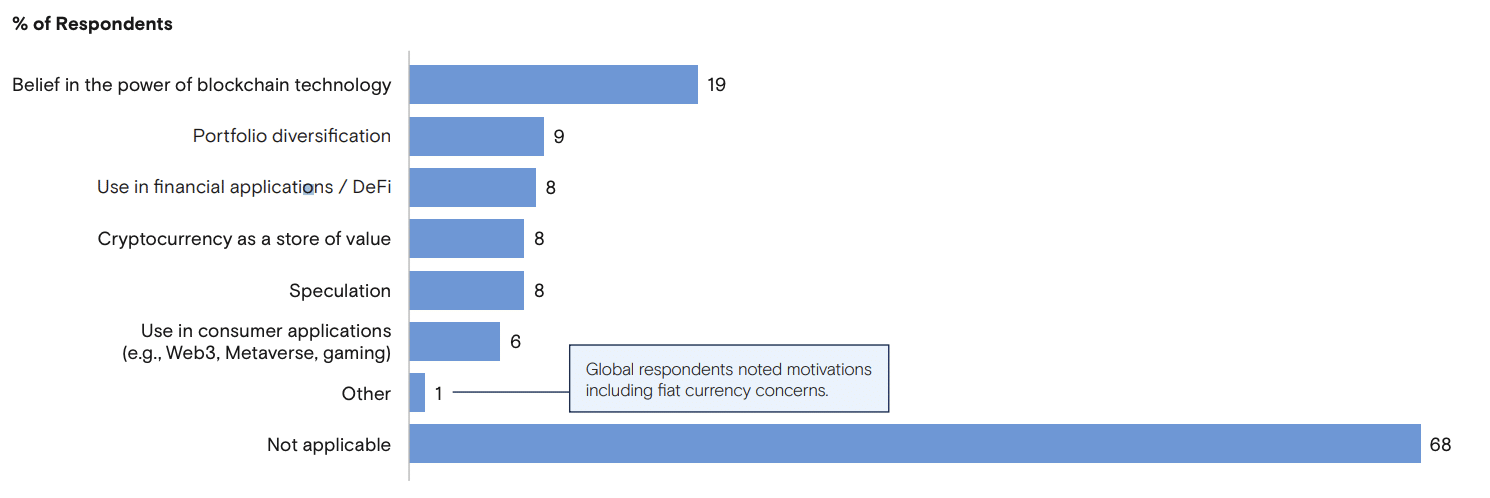

Explaining their motivations for investing in digital assets, most (19%) cited a belief in the power of blockchain technology, with only 8% and 9% citing speculation and portfolio diversification, respectively.

Related: Concern over banking crisis reaches levels unseen since 2008 — Poll

The proportion of investments in cryptocurrencies among investors interested in digital finance has risen significantly since 2021, from 16% to 26%. However, the interest in potential investments in crypto has crashed this year, with just 12% of investors indicating it, down from 45% in 2021. As highlighted in the report:

“Opinions on cryptocurrencies seem to have crystallized: a greater proportion of family offices are now invested in cryptocurrencies, but the proportion that are not invested and not interested in investing in the future has grown more.”

The report is based on a survey conducted between January and February 2023 via questionnaires distributed to home offices by email. Overall, 166 home offices participated, 95 of which are based in the Americas, 34 in Europe and the Middle East, and 37 in the Asia Pacific.

Goldman Sachs appeared among the top winners during the recent banking crisis, with many investors deciding to rotate their portfolio investments. Goldman Sachs’ money funds have received $52 billion — a 13% growth — in the biggest monthly volume of inflows since the emergence of the COVID-19 pandemic.

Magazine: Crypto audits and bug bounties are broken: Here’s how to fix them