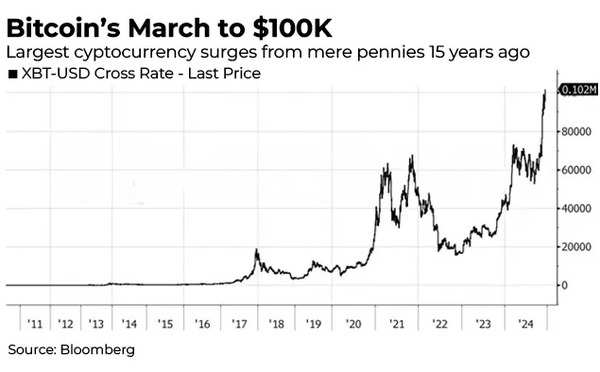

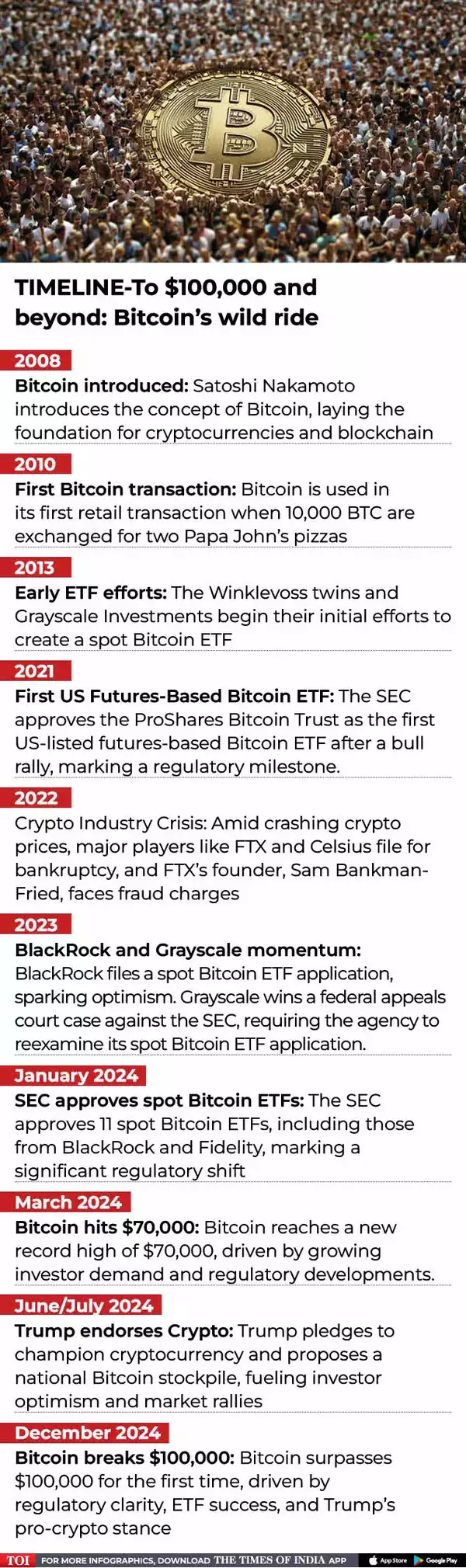

Bitcoin, the world’s most recognized cryptocurrency, has breached the $100,000 mark for the first time, riding a wave of optimism tied to the election of Donald Trump as US president. The cryptocurrency reached a peak of $103,800 on December 5, driven by Trump’s pledge to make the US the “crypto capital of the planet” and his nomination of Paul Atkins, a staunch cryptocurrency advocate, to chair the Securities and Exchange Commission (SEC). The announcement has electrified the crypto community, signaling a potential overhaul in regulatory approaches.

Why it matters

- This unprecedented milestone reflects not only the volatile nature of Bitcoin but also a broader geopolitical and economic shift.

- The United States has emerged as the dominant force in cryptocurrency, a title previously held by China. Trump’s victory has injected new life into the sector, buoying investor confidence and setting the stage for a transformative era in digital finance.

- Bitcoin’s ascent highlights the growing mainstream acceptance of digital currencies as a legitimate asset class and the pivotal role of US policies in shaping global financial trends. With the US pulling ahead, the landscape for digital assets is set to change dramatically.

The big picture: How China lost the plot to US

China, once the epicenter of Bitcoin mining and trading, has ceded its dominance due to a series of aggressive regulatory crackdowns.

China initially dominated the Bitcoin landscape, particularly in mining, leveraging its abundant, low-cost electricity and manufacturing capabilities. By 2017, over 70% of Bitcoin’s mining capacity was located in China, making it a pivotal player in the network’s governance. However, this dominance was short-lived due to regulatory clampdowns. In 2017, China banned Initial Coin Offerings (ICOs) and shut down local cryptocurrency exchanges.

In 2021, Beijing banned Bitcoin mining and declared cryptocurrency transactions illegal, citing concerns over financial stability, fraud, and energy consumption. These actions drove miners and crypto businesses out of the country, with many relocating to other crypto-friendly nations and regions.

Key factors behind China’s decline

- Regulatory crackdowns: China’s 2021 ban on crypto mining and trading forced businesses to flee, with many miners relocating to the US, where states like Texas offered cheap energy and favorable policies.

- Capital controls: The Chinese government’s strict limits on capital outflows conflicted with the borderless nature of cryptocurrencies, leading to concerns over financial instability.

- Energy concerns: Bitcoin mining’s massive energy consumption clashed with China’s climate goals, prompting the government to crack down on operations using non-renewable energy sources.

- Missed opportunities: While China has focused on its central bank digital currency (CBDC), the digital yuan, its restrictions on private cryptocurrencies have stifled broader innovation.

The US advantage

The US has capitalized on China’s retreat, leveraging its decentralized regulatory environment, robust financial markets, and culture of innovation to attract crypto talent and investment. The launch of spot Bitcoin ETFs in January was a game-changer, drawing over $4 billion in institutional investments this year alone. These ETFs have provided a gateway for traditional investors to gain exposure to Bitcoin, driving its value higher.

The entrepreneurial spirit in the US has also fostered the development of blockchain technologies, decentralized finance (DeFi) platforms, and non-fungible tokens (NFTs), cementing its position as a global leader in digital innovation.

How Trump changed the game

- Trump’s campaign promises have resonated strongly with the crypto industry. His pro-crypto stance included plans to establish a strategic Bitcoin reserve using assets seized by the government and to create a national advisory council for cryptocurrency. These proposals, coupled with the nomination of Paul Atkins as SEC chair, indicate a shift towards a more supportive regulatory framework.

- Atkins, a former SEC commissioner and a vocal critic of overregulation, is expected to dismantle the enforcement-heavy approach of his predecessor, Gary Gensler. Gensler’s tenure was marked by lawsuits against crypto firms and allegations of stifling innovation. Under Atkins, the SEC is likely to prioritize fostering innovation while maintaining investor protections, aligning with Trump’s vision of making the US a global leader in digital assets.

- Trump’s influence extends beyond policy. His engagement with the crypto community, including speaking at Bitcoin conferences and launching World Liberty Financial with family members, has imbued the industry with confidence.

- This has translated into a significant price surge for Bitcoin. Since Trump’s election victory on November 5, Bitcoin’s price has surged approximately 45%, fueled by a wave of buying that funneled capital into US bitcoin-backed exchange-traded funds (ETFs).

- The overall crypto market has gained about $1.3 trillion in value since Trump’s win, reflecting his platform’s alignment with the cryptocurrency sector. US Bitcoin ETFs have attracted net inflows of approximately $32 billion this year, with over $8 billion pouring in since Trump became president-elect, according to Bloomberg data. Meanwhile, CCData reports that combined trading volumes for digital assets and related derivatives on centralized exchanges hit a record $10 trillion last month.

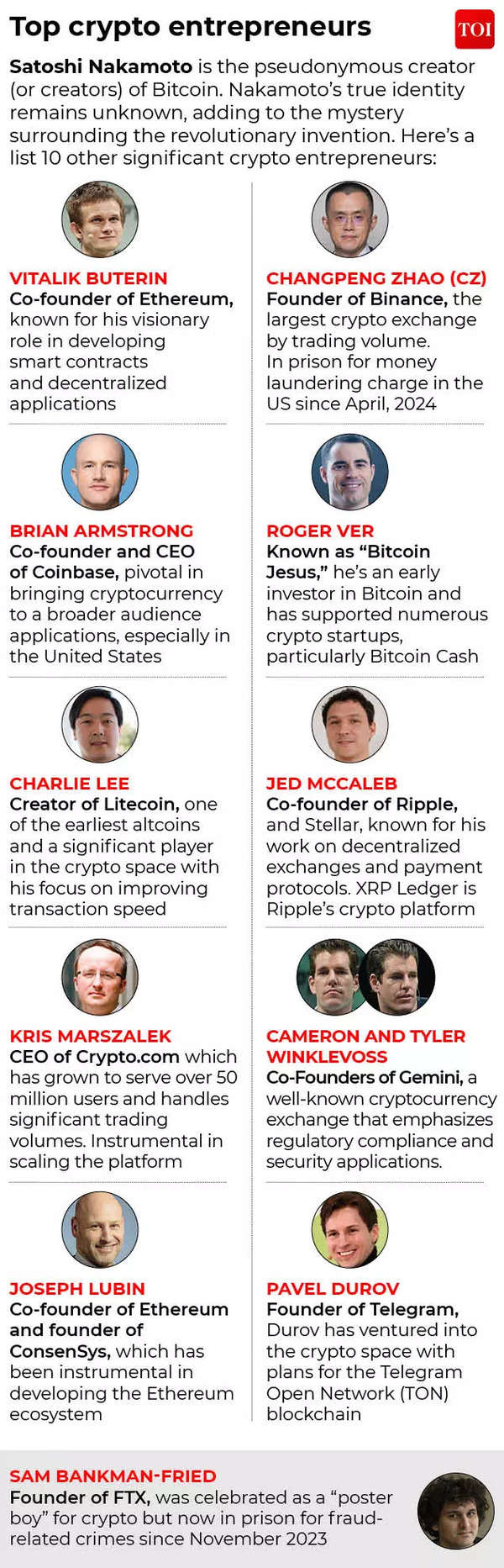

- Bitcoin’s journey from the libertarian fringe to Wall Street has minted millionaires, established a new asset class, and popularized “decentralized finance” during a volatile 16 years since its creation.

What they’re saying

The milestone of Bitcoin crossing $100,000 has elicited a wide range of reactions from industry leaders, financial experts, and crypto analysts, reflecting both the excitement and caution that characterize the volatile world of cryptocurrencies. Here are some experts views as per a Reuters report:

Shoki Omori, Chief Japan Desk Strategist, Mizuho Securities, Tokyo

“Individual investors must be excited to see the BTC price top $100,000 following the news of Paul Atkins being nominated as SEC chair… Of course, this doesn’t mean BTC will rally forever, as there will be moves to take profits.”

Jeff Mei, COO at BTSE, Hong Kong

“Bitcoin’s surge past the $100,000 mark is not just a milestone; it represents a pivotal moment for the cryptocurrency industry. The confidence is spurred by an increasingly favourable regulatory environment in the U.S.”

Geoff Kendrick, Global Head of Digital Assets Research, Standard Chartered, London

“At the end of the day, it’s just a number…but the reality is we’ve been able to get to this level because the industry has become institutionalised this year particularly – and that’s mostly the ETF inflows.”

Kyle Rodda, Senior Financial Market Analyst, Capital.com, Melbourne

“It’s a massive milestone for the true believers and possibly evidence of the asset’s legitimisation… Given the reduced regulatory risk and greater geopolitical risks, there are continued tailwinds that could support prices going higher.”

Justin D’Anethan, Independent Crypto Analyst, Hong Kong

“Bitcoin crossing $100,000 is more than just a milestone; it’s a testament to shifting tides in finance, technology, and geopolitics. Institutional adoption is evident, as seen by the increased volume on the CME, ETFs, and derivatives markets during US hours.”

Ray Attrill, Head of FX Research, NAB, Sydney

“It’s the ultimate speculative asset, isn’t it. The test will be if we do have a big puke in risk sentiment at some point, and we start to see a major stock market correction.”

Richard Teng, Chief Executive Officer, Binance, Dubai

“Bitcoin has reached the landmark milestone of $100K per coin, placing the asset at a total market capitalisation of $2.1 trillion. We are on the precipice of true mainstream global adoption.”

A bit about bitcoin cycle and halving

- Bitcoin operates on a cyclical model that is largely influenced by its halving events, which occur approximately every four years. Bitcoin’s most recent halving event occurred on April 19, 2024, marking its fourth halving. Historically, such halvings have been pivotal moments in Bitcoin’s lifecycle, often leading to significant changes in market dynamics and price movements.

- In fact, each cycle can be broken down into four main phases: the halving, a bullish phase, a market crash, and a stabilization period. The halving event reduces the block reward for miners by 50%, effectively slowing the rate at which new Bitcoin enters circulation. This reduction in supply typically leads to increased demand and subsequent price rises, initiating a bullish phase characterized by speculation and heightened buying activity.

- Historically, this phase has seen Bitcoin’s price reach new all-time highs as investors respond to the perceived scarcity of the asset.

- Following the peak of the bullish phase, Bitcoin often experiences a significant market downturn, commonly referred to as a crash. This crash can be driven by profit-taking among investors, panic selling, or broader market corrections. After this downturn, Bitcoin enters an extended stabilization period, sometimes dubbed “Crypto Winter,” where prices stabilize at lower levels for an extended time—typically lasting around two years. During this phase, the market sentiment tends to be bearish, but it also provides opportunities for accumulation as prices are relatively low compared to previous highs. This cycle continues as anticipation builds for the next halving event, which reignites interest and investment in Bitcoin.

Between the lines

Trump’s pro-crypto policies have not only bolstered the US market but have also highlighted the limitations of China’s approach. While China’s digital yuan aims to challenge US economic dominance, its hostility toward private cryptocurrencies has created a vacuum that the US has been quick to fill.

Geopolitically, the shift underscores a broader narrative: countries that embrace innovation and regulatory flexibility are better positioned to lead in emerging sectors like blockchain and cryptocurrency. As the US strengthens its foothold, the question remains whether China will pivot to a more crypto-friendly stance or double down on its restrictive policies.

Environmental and social concerns

Bitcoin’s rise has reignited debates over its environmental impact. The energy-intensive process of Bitcoin mining has drawn criticism, particularly in countries relying on fossil fuels. Recent research highlights that Bitcoin’s carbon footprint in 2021 was equivalent to burning 84 billion pounds of coal. However, industry leaders argue that the increased use of renewable energy in mining operations is mitigating these concerns.

Critics also point to Bitcoin’s association with illicit activities, such as money laundering and ransomware attacks, as challenges that must be addressed for broader adoption.

What’s next

- Strategic Bitcoin Reserve: Trump’s proposal to establish a national reserve of Bitcoin using seized assets could further legitimize the cryptocurrency, potentially encouraging other nations to follow suit.

- China’s response: While experts doubt that Beijing will reverse its ban on private cryptocurrencies, Hong Kong may serve as a sandbox for crypto activities, providing a limited pathway for China to re-enter the market.

- Market trajectory: Analysts are optimistic about Bitcoin’s future, with some predicting a rise to $120,000 by 2025 as reduced regulatory risks and geopolitical instability boost its appeal as a hedge against traditional currencies.

- The bottom line: Bitcoin’s historic rise to $100,000 marks a turning point in the global cryptocurrency landscape. The US, under Trump’s leadership, has seized the opportunity to become the epicenter of digital asset innovation, leaving China in its wake.

- “Investors must remember that an asset doesn’t go up in a straight line forever,” Josh Gilbert, market analyst at eToro, told Bloomberg. “Drawdowns for Bitcoin are par for the course, but it feels like it’s going to take something big to slow down Bitcoin right now.”

(With inputs from agencies)