Shiba Inu (SHIB) prices are trending sideways below the moving average lines.

Shiba Inu price long term forecast: in the range

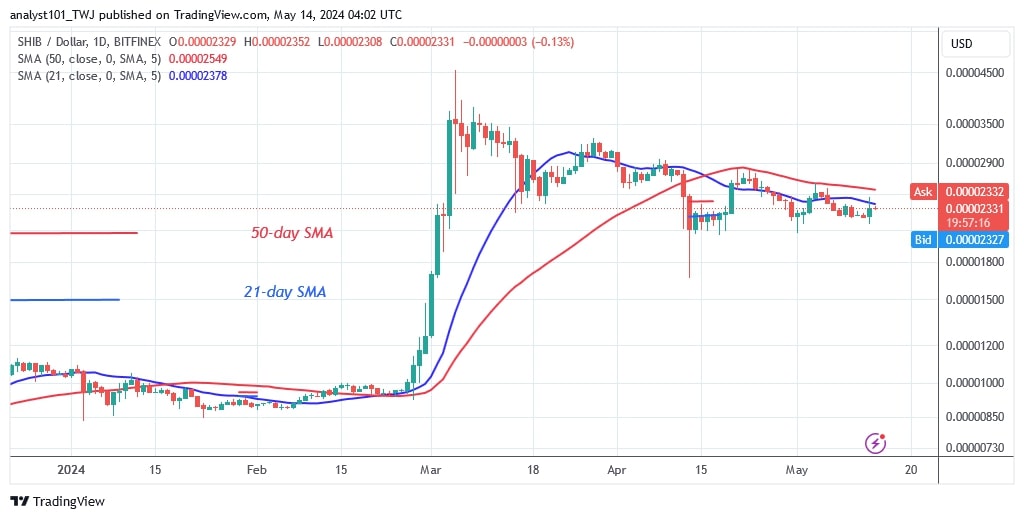

Since April 14, 2024, the bulls have kept the drop above the support level of $0.00002060 as it started its sideways trend. The altcoin is currently trading within a range of $0.00002060 and below the 21-day moving average line.

Over the past month, buyers have failed to keep the price above the moving average lines. On May 10, the bears drove the altcoin to a low of $0.00002221 before moving back up. Today’s bullish momentum has reached the 21-day SMA resistance line. SHIB will fall if it fails to break above the 21-day SMA resistance line. The sideways movement will continue if the price of the cryptocurrency falls and stays above the $0.00002060 support level. If the current support is broken, the price drop could go as low as $0.00001664. SHIB is now worth $0.00002388.

Analysis of the Shiba Inu indicators

The price bars are below the moving average lines to the south. On both charts, the moving average lines have a bearish crossover, indicating a bearish signal. However, the dip has subsided and the altcoin has resumed its sideways pattern.

Technical indicators

Key resistance levels: $0.00001200, $0.00001300, $0.00001400

Key support levels: $0.00000600, $0.00000550, $0.00000450

What’s next for Shiba Inu?

SHIB/USD will continue to move sideways as the altcoin slips into its range bound zone. Nonetheless, the current trend will be broken if buyers break the moving average resistance lines. The sideways trend will end if the bears break the current support level of $0.00002060. In the meantime, the cryptocurrency price has retested the 21-day SMA and resumed its positive trend.

Disclaimer. This analysis and forecast are the personal opinions of the author and are not a recommendation to buy or sell cryptocurrency and should not be viewed as an endorsement by CoinIdol.com. Readers should do their research before investing in funds.