- Litecoin price is observing a bearish downturn as the market cools down following profit saturation.

- LTC whale addresses have been acting as a buy/sell signal for a while now and could suggest the next direction of price action.

- The overall macro profit percentage suggests that investors are still prone to selling for gains, which might lead to a price fall.

Litecoin price rise might have tapped out sooner than expected, but as with the rest of the crypto market, one cannot ascertain what lies next for the altcoin. Interestingly, the answer is not as hidden as it may seem; in fact, it remains in the hands of the whale addresses more than the macro market cues.

Litecoin price to see further decline

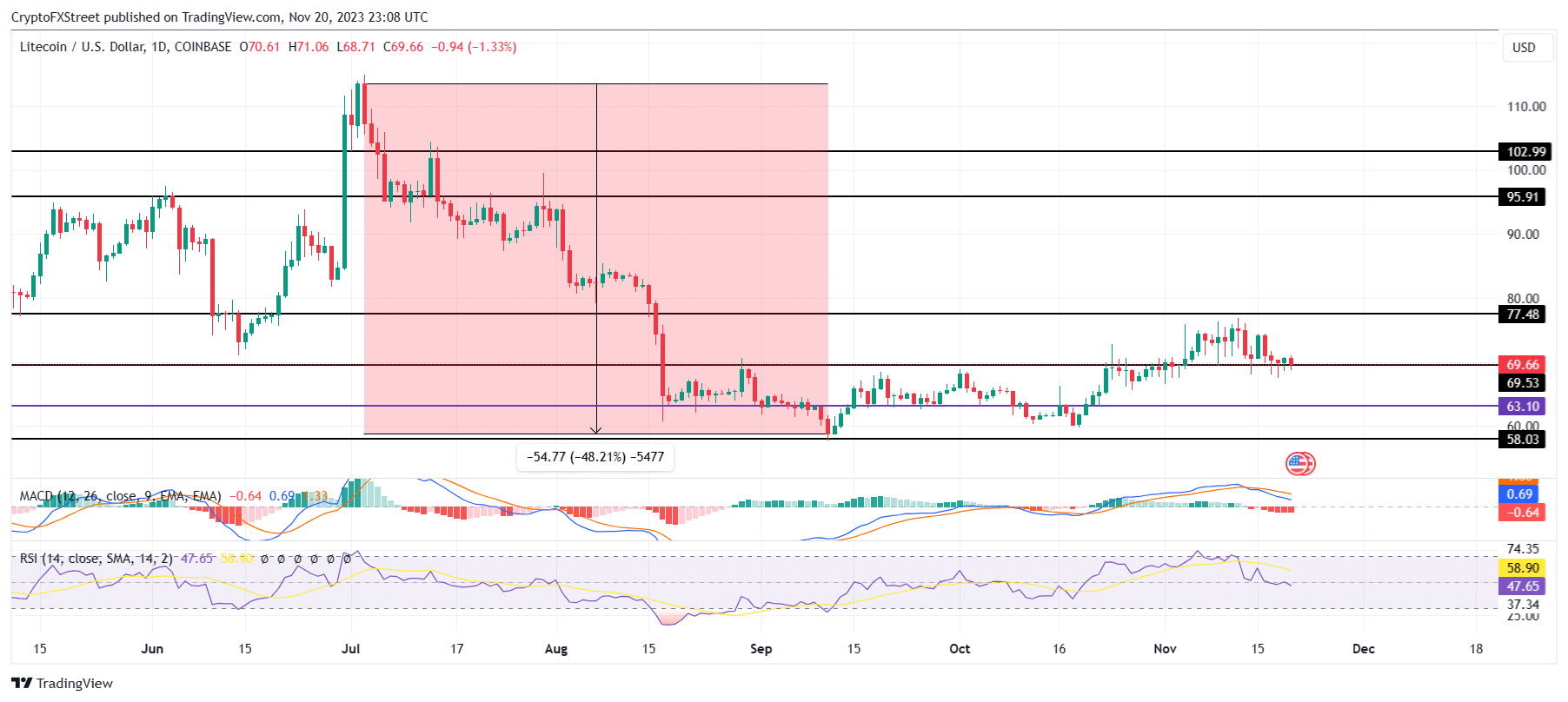

Litecoin price noted a 25% increase in price in the second half of October, but over the past two weeks, the altcoin has observed a consistent decline. Down to $69, LTC has already lost the $70 support and could be looking at likely shedding all the recent gains by falling to $63.

Testing the $69.53 support line, the price indicators evince a bearish turn of events is likely. The Moving Average Convergence Divergence (MACD) indicator is already suggesting a decline with the bearish crossover occurring this week. The Relative Strength Index (RSI) is also presently below the neutral line at 50.0, sitting in the bearish zone.

Thus, Litecoin price remains prone to a crash to $63.10, which could not only send the altcoin to a monthly low but also wipe the recent 25% gains noted by LTC holders.

LTC/USD 1-day chart

But if LTC holders decide to refrain from selling right now and hold on to ensure Litecoin price prevents a fall below $69, the bearish conviction would be weakened. This would suggest that LTC could see some sideways movement for a while before noting a bullish momentum once again.

Litecoin whales are the cue

Litecoin price rise or decline might depend on the demand and supply of the asset but at the moment, the most clear signal is coming from a much more reliable source – the whales. LTC whale addresses holding between 100,000 and 1 million LTC, which has had a significant influence on the direction of the price action for a while now.

Presently holding 25.65 million LTC, these addresses’ next move would hint at whether the cryptocurrency would see a rise or a decline. But by the looks of it, Litecoin whales might be looking at selling over the next couple of days as the market is teeming with profits.

Litecoin whale holdings

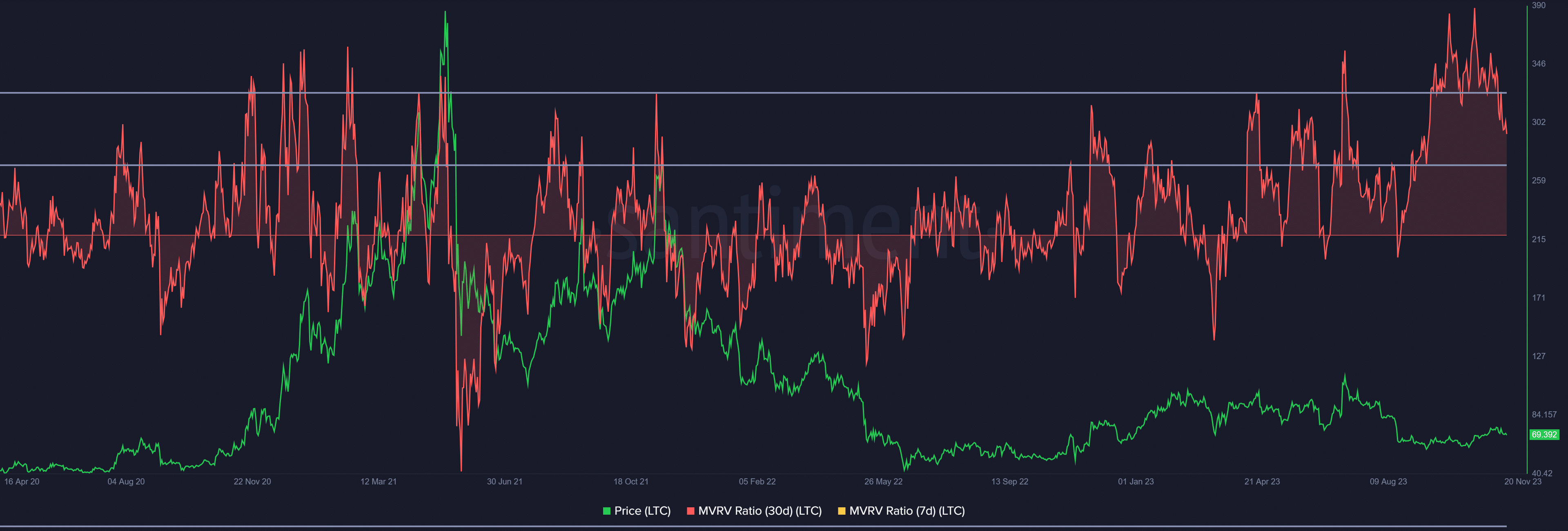

This is evident in the Market Value to Realized Value (MVRV) ratio as well. The MVRV ratio is an indicator that is used to assess the average profit/loss of investors who purchase an asset. The 30-day MVRV ratio measures the average profit/loss of investors who purchased an asset in the past month.

In the case of Litecoin, the 30-day MVRV sits at 19.85%, which indicates that investors who purchased LTC in the past month are sitting at nearly 20% profit. They are prone to selling their holdings to book profits, which could trigger a sell-off. As seen in the chart, when MVRV hits 12% to 28%, LTC has undergone major corrections. Hence, this area is termed a danger zone.

Litecoin MVRV ratio

Thus, all signs point to a decline in Litecoin price; however, the helm of the market lies with the whales.