Despite the recent decline, the price of Solana (SOL) is above the moving average lines. Solana price analysis by Coinidol.com.

Solana price long term prediction: bullish

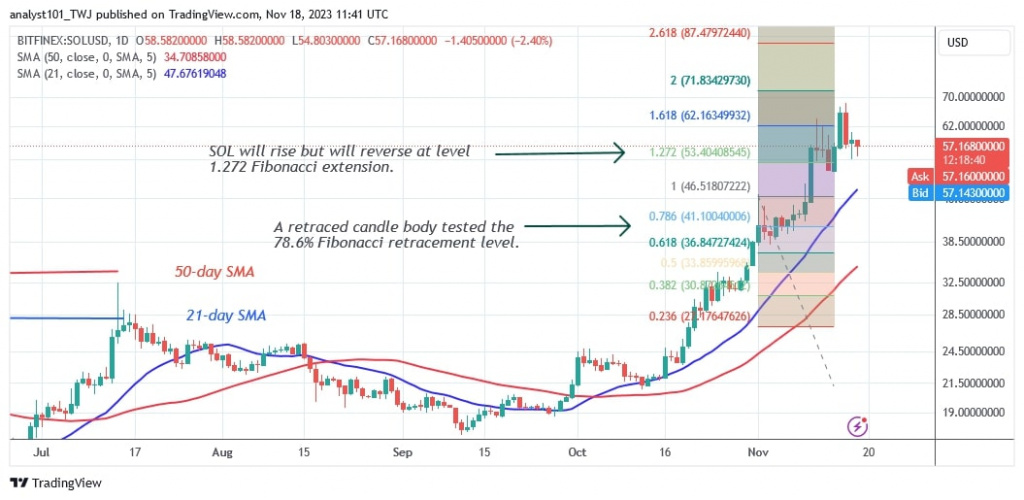

The price of Solana (SOL) has declined after reaching a high of $68 on November 16. The current rally has been nipped in the bud below the $70 mark. The altcoin has been trading below the resistance level for the past three days, indicating a likely return of the rally. The $70 resistance zone limits the upside. Solana is currently being sold in the $54-$70 range.

Buyers are still struggling to break through the $70 resistance level. If the buyers break the resistance zone, the altcoin will reach a high of $90.

The upward movement is shaky because the market has reached the overbought zone. The current rise will end if the cryptocurrency falls below the 21-day SMA or the $54 support level. The altcoin will fall to a low of $41.

Analysis of the Solana price indicator

The price of the cryptocurrency has slipped below the moving average lines on the 4-hour chart, indicating more to come. The upward sloping moving average lines indicate that the uptrend has reached the overbought zone.

Technical indicators

Key supply zones: $60, $65, $70

Key demand zones: $30, $25, $20

What is the next move for Solana?

Solana has entered the overbought zone after reaching a high of $70. The upswing has stalled below the last high. The price of the cryptocurrency is oscillating between $54 and $70. Breaking through these levels will determine the further course of the cryptocurrency. Nevertheless, the overbought situation of the cryptocurrency will have an impact on its uptrend.

On November 11, the altcoin exceeded expectations and reached a high of $63.95. And was trading below the $64 barrier on November 12, as Coinidol.com reported.

Disclaimer. This analysis and forecast are the personal opinions of the author and are not a recommendation to buy or sell cryptocurrency and should not be viewed as an endorsement by CoinIdol.com. Readers should do their research before investing in funds.