- Chainlink is likely to see further price gains in the short-term, according to several on-chain metrics.

- Chainlink Weighted Sentiment entered positive territory, while supply on exchanges has declined.

- LINK price rose almost 25% in a week and nearly doubled over the past month.

Chainlink, the token of a decentralized blockchain oracle network, doubled its price in the past month. LINK price is likely to extend its gains with bullish on-chain metrics.

Also read: Bitcoin price targets the $49,000 level as analysts predict approval of BTC spot ETFs by SEC

Chainlink on-chain metrics that support bullish outlook

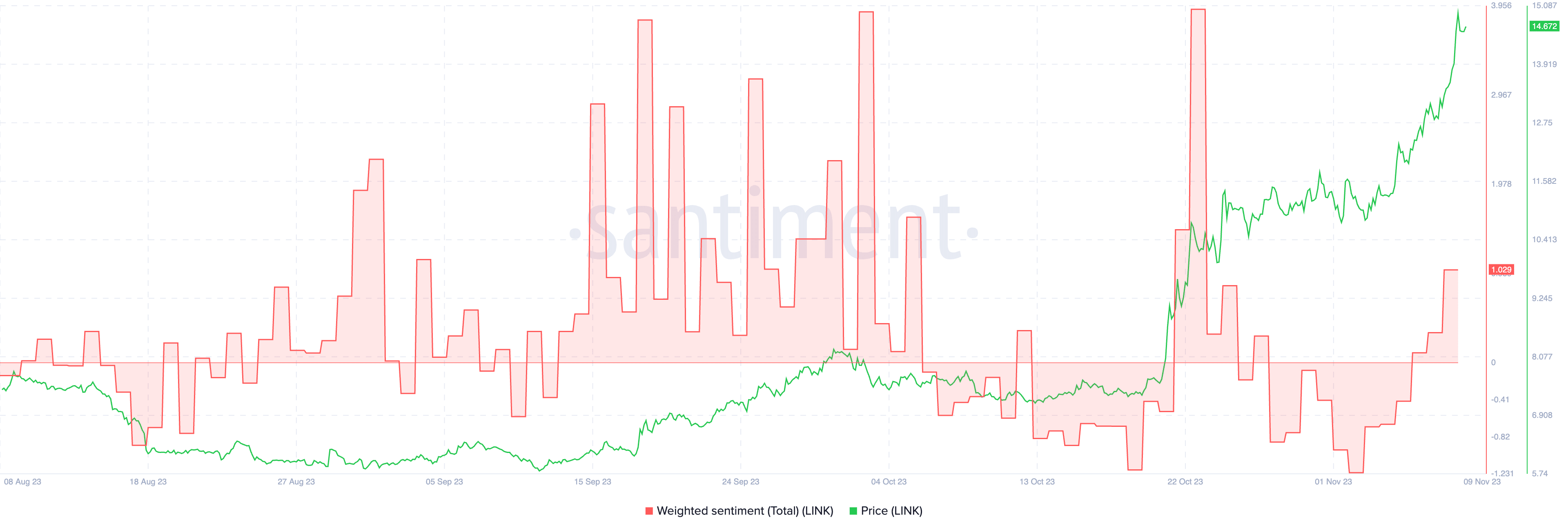

Chainlink’s social media mentions have climbed across platforms like X. The sentiment of market participants towards LINK is measured by Weighted Sentiment, a metric that acts as a temperature check among traders in the ecosystem.

Based on data from crypto intelligence tracker Santiment, there is an increase in the weighted sentiment of LINK. The metric climbed to 1.029 on November 8.

Weighted sentiment LINK

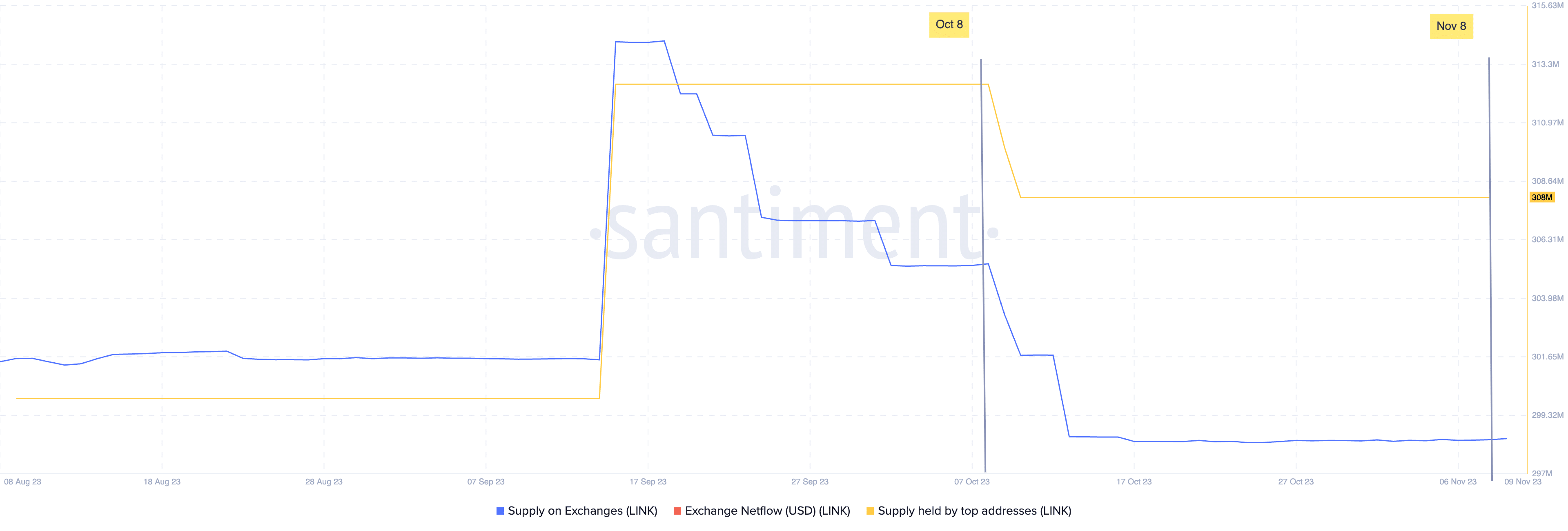

The supply of the token on exchanges has declined over the past three months. The Supply held by top addresses dropped between October 8 and November 8, similar to the supply on exchanges.

The reduction in selling pressure is conducive for the asset’s extended gains.

Supply on Exchanges, Supply held by top addresses

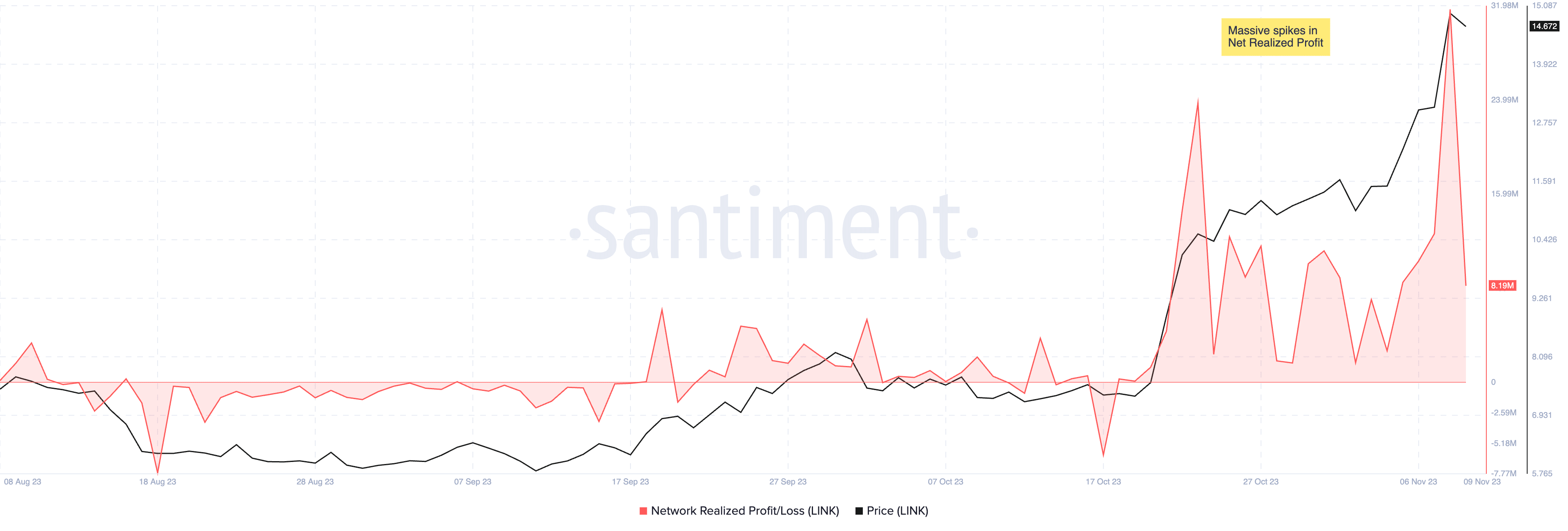

Net Realized Profit/Loss calculates the average profit/ loss of all coins that change addresses on a daily basis. The metric noted massive spikes in profit between October 18 and November 8.

Spikes in realized profit can be correlated with local top formation in an asset. LINK is therefore likely close to a local top.

Network realized profit/loss LINK

LINK price climbed almost 25% in the past week and doubled in the past 30 days on Binance. The oracle token has noted a rise in accumulation by retail traders, driving demand for LINK higher. LINK price is $15.13 at the time of writing.