- Bitcoin price uptrend may be exhausted for the short term, as the $35,500 level pressures BTC.

- Ethereum price at crossroads below $1,935 mean threshold represents a make-or-break moment for the largest altcoin by market capitalization.

- Ripple price’s bullish momentum continues to build, but the supply barrier ahead may pose a challenge with $0.800 likely to hold.

Bitcoin (BTC) has been consolidating below $35,500 for almost two weeks now, being static, with analysts attributing the slow-down in pace to the absence of ETF-related news. With its Ethereum (ETH) and Ripple (XRP) prices have also come to a halt, facing critical barriers that will determine the next move.

Also Read: Bitcoin and Ethereum price rise halting makes way for layer-2 & DeFi tokens to chart over 40% gains

Bitcoin price marks time below $35,954

Bitcoin (BTC) price is marking time below the $35,954 level after a steady 40% climb that began in mid-September. Exchanging hands for $35,091 as of press time, the rally seems exhausted, with the price showing reluctance around the $35,500 level. The bulls are likely to take a breather as the Relative Strength Index (RSI) position shows BTC is massively overbought.

With this outlook, it is likely that Bitcoin price could correct soon, likely for the short term, before a continuation of the primary trend. Likely targets in a downward directional bias include the $32,000 psychological level, a critical juncture having capped the upside potential for the king of cryptocurrencies since May 2022 when the Terra (UST) ecosystem fell off a cliff.

The RSI deviated from the northbound move, flattening to show complacency as buying pressure continues to weaken. This observation favors the downside.

BTC/USDT 3-day chart

However, if sidelined investors join the bull’s camp, Bitcoin price could continue north, breaking past the $35,954 resistance level with a breakout objective above the $40,000 psychological level. In a highly bullish case, the gains could extrapolate for BTC to test the supply zone extending from $44,321 to $47,122, with the $48,000 handle presenting the next logical target, a level last seen in March 2022.

Also Read: Holders of $600 billion worth of BTC are asking for Bitcoin price to rally not by 15% but by 96%

Ethereum price on collision with $1,035 mean threshold

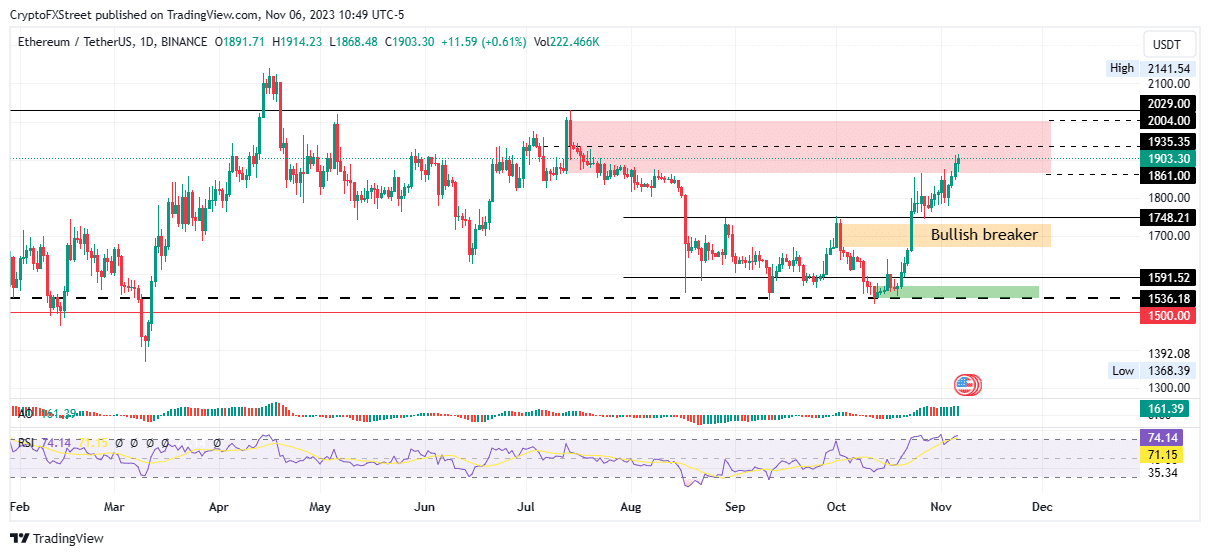

Ethereum (ETH) price’s 22% uptrend that started on October 13 has the second largest cryptocurrency by market capitalization confronting a crucial barrier – the $1,935 mean threshold of a supply zone extending from $1,861 to $2,004.

If Ethereum price records a daily candlestick close above the $1,935 midline, it would confirm the continuation of the uptrend, setting the tone for a successful foray above the $2,000 psychological level, with $2,029 as the next logical target.

ETH/USDT 1-day chart

A rejection from the $1,935 level could send Ethereum price spiraling south, potentially slipping below the $1,800 psychological level and testing the $1,748 support. Such a move would denote an 8% drop below current prices.

Also Read: Ethereum net exchange deposits hits five-month peak with almost 130,000 ETH flowing to exchanges

Ripple price eyes 10% more gains

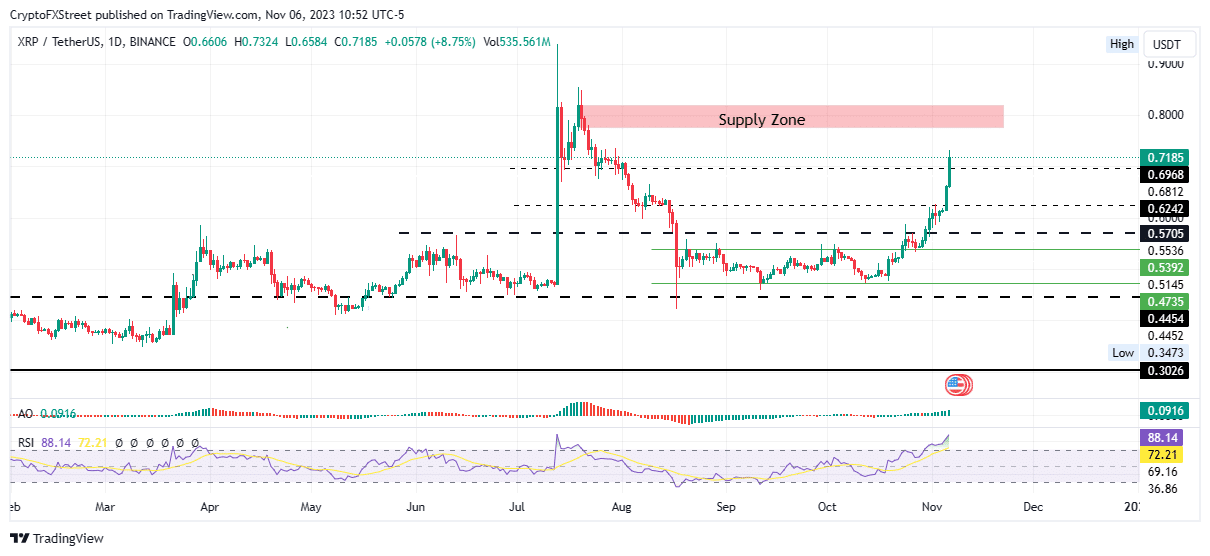

Ripple (XRP) price continues northbound, with robust higher highs and higher lows surpassing key barricades. Despite XRP being massively overbought, the primary trajectory of the RSI is still northbound, showing that momentum is still rising.

Increased buying pressure above current levels could see Ripple price test the supply zone extending from $0.7771 to $0.8199. For a confirmed uptrend, the price must break and close above the $0.8000 psychological level, with the move likely to catalyze an extension to the $0.9000 psychological level, 25% above the current price.

XRP/USDT 1-day chart

Conversely, with XRP being massively overbought, it is likely that the supply zone will hold as a resistance order block. The ensuing rejection could see Ripple price pull south, slipping through the $0.6968 support level and testing the $0.6242 support with bulls seeking rejuvenation. Another evaluation will be required at this point to determine the next step for XRP, considering the prevailing bullish outlook in the broader market.

Also Read: XRP price could extend gains with Ripple’s likely win through $20 million settlement with SEC

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.