- Ripple funding rate on Binance remains positive as the sentiment among traders in the perpetual swaps market turns bullish.

- Whale transaction count has declined, selling pressure on XRP is therefore likely to reduce.

- XRP price held steady above $0.55 after yielding 6.2% gains for holders on Binance.

Ripple price climbed to the $0.55 level, and offered 6.2% weekly gains to holders. As the asset sustains above the $0.50 psychological barrier, its rally is supported by bullish on-chain metrics. That said, there is a possibility of a correction in XRP price, if the asset drops to support at $0.50, it could plummet lower.

The downside is likely limited with bullish developments making headlines. XRP’s Chief Executive Officer, Brad Garlinghouse, recently voiced his dissent on former SEC Chief Jay Clayton’s comments in a Squawk Box interview.

Also read: XRP price likely to crash by 12%, suggests Ripple Whales activity

Daily Digest Market Movers: Ripple MVRV shows bullish outlook

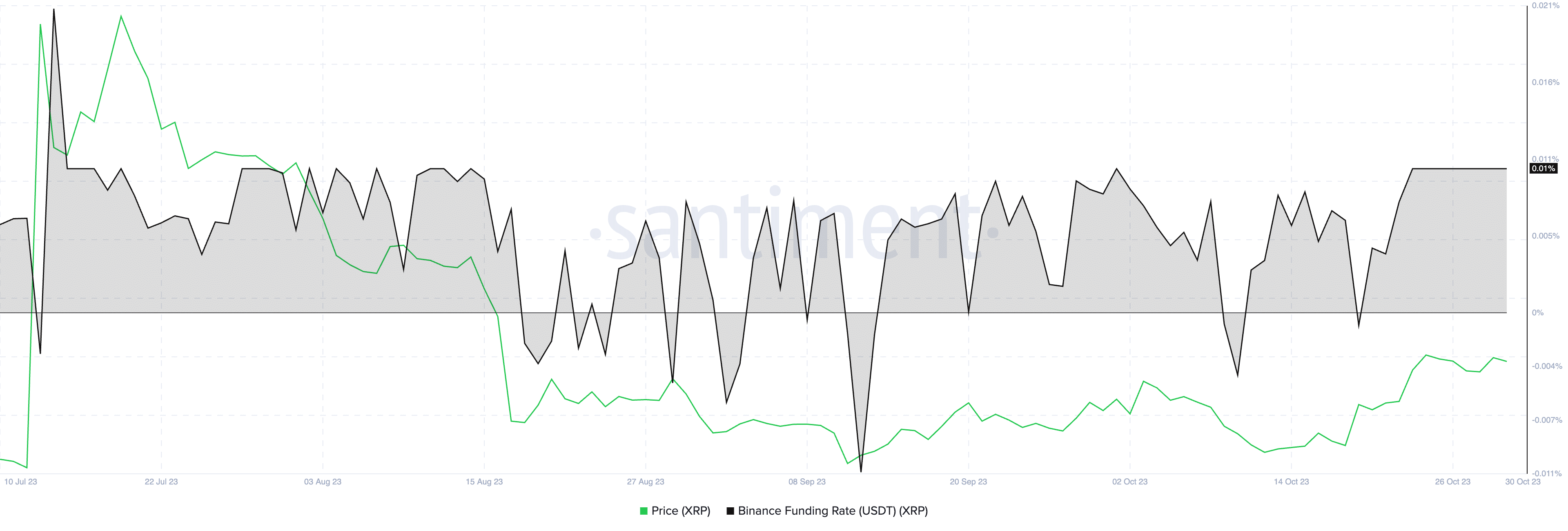

XRP funding rates remain positive, and support a positive outlook on the asset’s price. Funding rates is a metric that is used to predict market behavior and interpret the dominant sentiment among participants. A positive funding rate, like the current 0.01% implies that long position traders are dominant and are willing to pay funding to short traders, and the overall outlook is therefore bullish.

Based on Santiment data, XRP funding rate has trended positive since October 20, signaling a shift in the outlook, and supporting XRP price gains.

XRP price vs Binance funding rate (USDT)(XRP)

Another key on-chain metric that supports the altcoin’s gains is the declining whale transaction count. A recent spike in whale transactions between October 20 and 27, was recorded by Santiment in two segments, valued at $100,000 or higher and valued at $1 million or higher.

Based on the trend seen over the past six months, these transactions are typically followed by a correction in XRP price. However, early on Monday, whale transaction count in both segments noted a considerable decline, 37.3% and 50% respectively.

This shift possibly means whales have completed their profit-taking activities by shedding XRP holdings. The asset is less likely to suffer a price correction and XRP price could hold steady above the psychological barrier at $0.50.

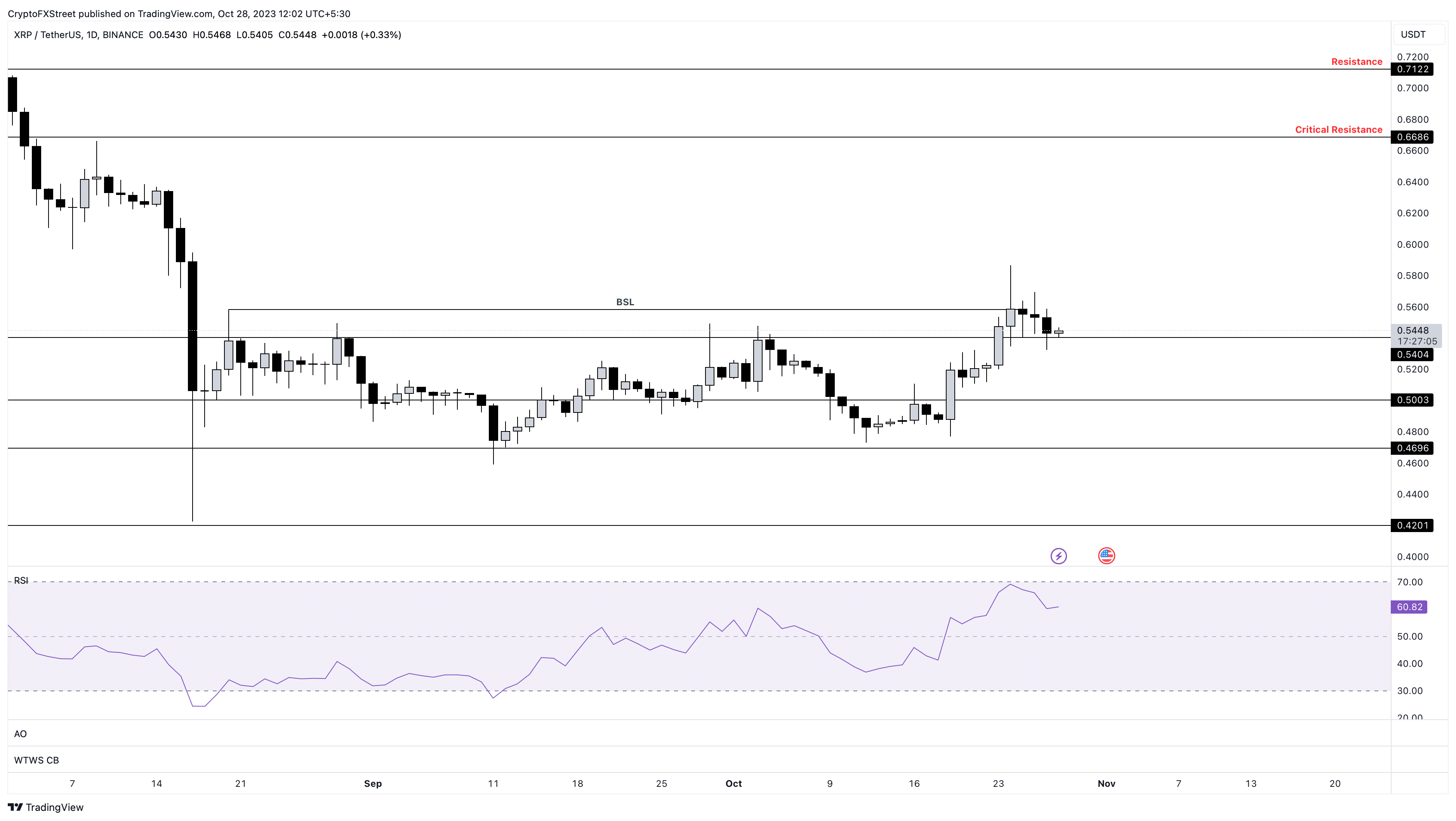

In response to former SEC Chief, Jay Clayton’s comments at CNBC’s Squawk Box, Brad Garlinghouse reminded the crypto community that Clayton had brought the lawsuit against the payment firm and its executives. Clayton argues that if the SEC does not receive pushback from the courts after suing businesses, then the regulator is not doing enough. The remarks incited criticism from Garlinghouse. Watching this clip makes my blood boil. The hypocrisy is shocking. @CNBC @SquawkCNBC should be calling him out for the bullshit. (As a reminder, jay clayton brought the case against ripple, me and Chris Larsen. And left the building the next day). — Brad Garlinghouse (@bgarlinghouse) October 28, 2023 Akash Girimath, lead technical analyst at FXStreet, evaluated the XRP price trend and predicted a 12% decline in the asset. Find out more here. Girimath’s thesis is based on the spike in XRP whale transactions, at a local top at $0.586. XRP price climbed 20% between October 19 and 24 and hit the asset’s local top. Ripple price has declined nearly 7% since the local top and the analyst predicts further decline in XRP price if bulls remain absent. A price drop could cause a breakdown of the $0.540 support level and push XRP to its $0.50 barrier, before sliding lower. XRP/USDT one-day price chart on Binance On the flipside, sustained bullish momentum could push XRP price to the $0.668 hurdle. XRP price has produced a higher high at $0.55, rising from $0.50 support level. If the remittance token sustains above this level, it is likely to witness a 20% price rally. The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. Since its inception, a total of 19,445,656 BTCs have been mined, which is the circulating supply of Bitcoin. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains. Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value. For Bitcoin, the market capitalization at the beginning of August 2023 is above $570 billion, which is the result of the more than 19 million BTC in circulation multiplied by the Bitcoin price around $29,600. Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency. Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions. Ripple CEO shocked at former SEC Chief’s comments

Technical Analysis: XRP price could crash 12% if this occurs

Cryptocurrency metrics FAQs