Crypto data analytics platform Kaiko has shared its insight on the factors guiding the latest rally in Bitcoin price. According to the platform, the growth of Bitcoin price to $35,000 is linked to four different factors including volume, implied volatility, market depth, and funding rates.

Kaiko on Factors Underlying Bitcoin Price

According to Kaiko, a real shift in market structure has been observed for the first time in the past six months. The analytics platform noted that despite a slowdown in trading volume and lower volatility during the summer, things changed in the past two weeks when there was a rumor about the fake approval of the Bitcoin spot ETF linked to BlackRock.

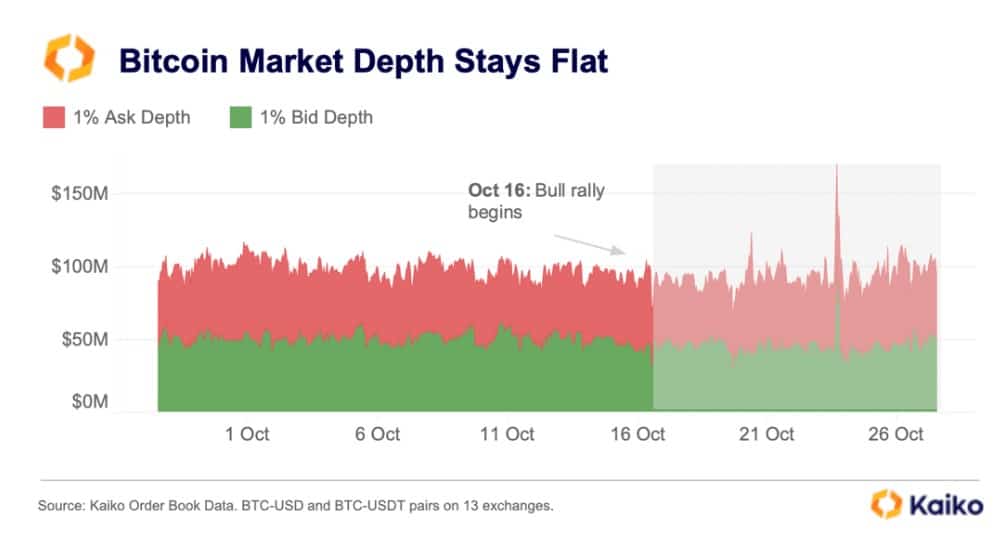

Kaiko observed that the market did not care that Bitcoin’s price was being pushed back as it hit the highest level since May 2022. As part of its investigation, Kaiko said Bitcoin’s liquidity has remained flat even though the trading activities increased. Notably, the platform noted that the bids and asks on order books within 1% of the mid-price – have remained flat over the past two weeks at around $100 million.

Kaiko submitted that the market is expecting near-term volatility with no volume-inducing catalyst by December. One catalyst that may fuel market intrigue, however, is the anticipation of the news on a spot Bitcoin ETF from the SEC due for January.

In all, Kaiko highlighted that Bitcoin’s correlation with equities including the Nasdaq 100 has dipped into negative territory for the first time since July, an indication Bitcoin price is also not immune to the geopolitical war between Israel and Hamas.

Bitcoin Predictions from Market Leaders

While the Kaiko report underscored the reaction of the market in line with related Bitcoin price moves, experts foresee a bullish turn for Bitcoin in the long term.

“Rich Dad Poor Dad” author Robert Kiyosaki recently labeled Bitcoin as one of the assets that investors must make allocations in to escape the impending economic crash. In line with his 25% allocation recommendation to Bitcoin and Real Estate, Kiyosaki has a $135,000 price target for BTC.

Besides Kiyosaki, market leaders like Ark Invest’s Cathie Wood also believe Bitcoin price can hit $1 million by 2030 with BTC ETF approval marked as the potential catalyst that can power this growth. With Kaiko’s take and broader sentiment, market will be the decider on whether Bitcoin’s price will continue to rally as the year comes to an end.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

✓ Share: