The excitement around the spot Bitcoin ETF has been catching up quickly with market players making predictions regarding its arrival. Galaxy Research has recently published a report stating that Bitcoin ETF will attract $14 billion in inflows during the first year of launch.

Estimating Inflows into Bitcoin ETF

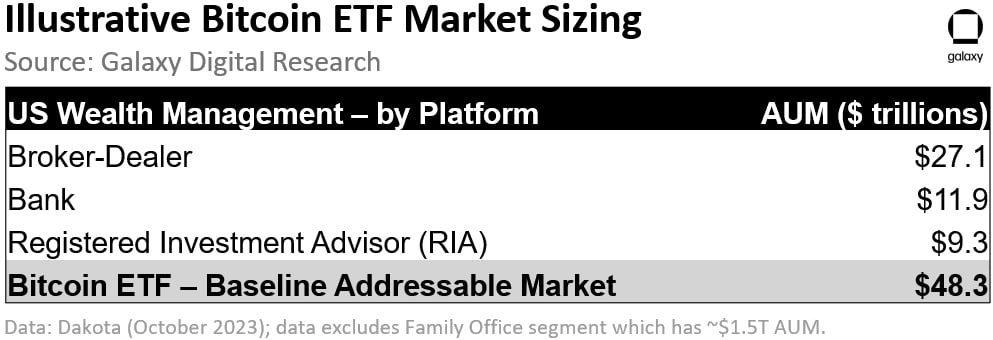

In their report, Galaxy Research notes that the US wealth management industry represents the most accessible and direct market for a potentially approved Bitcoin ETF to tap into. As of October 2023, the combined assets under management by broker-dealers ($27 trillion), banks ($11 trillion), and Registered Investment Advisors (RIAs) ($9 trillion) amounted to $48.3 trillion.

In their analysis, they used this $48.3 trillion as the Total Addressable Market (TAM) baseline for selected US wealth management aggregators. It’s important to note that the addressable markets and the indirect impact of a Bitcoin ETF approval are likely to extend beyond the US wealth management sector, potentially reaching international markets, retail investors, other investment products, and various channels. This broad reach could attract significantly larger inflows into Bitcoin spot markets and investment products, notes Galaxy Research.

Key Assumptions for Determining inflows

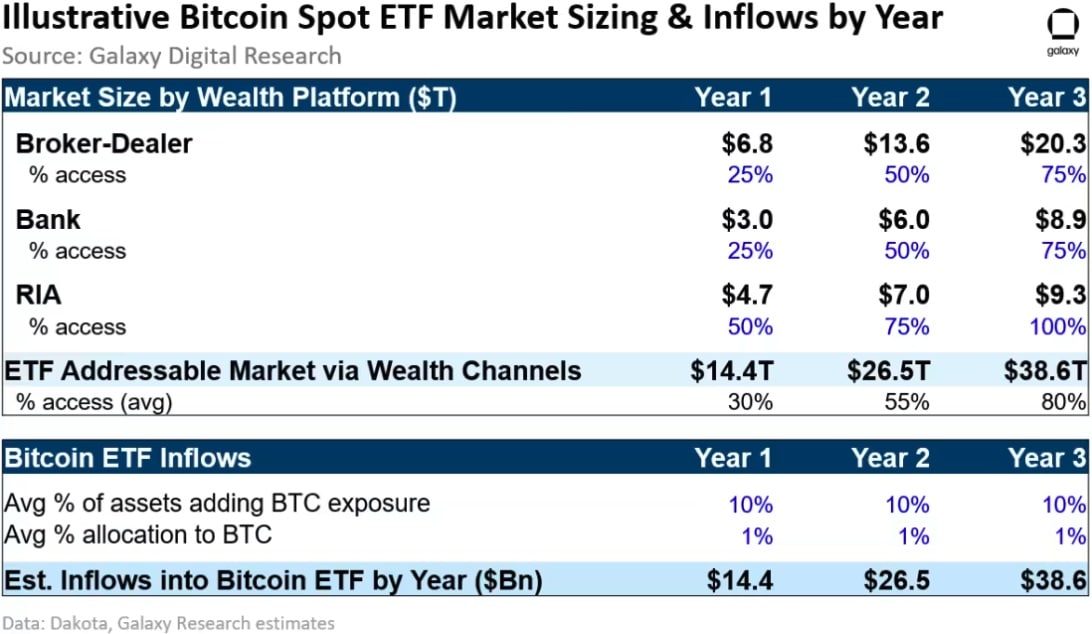

Galaxy Research’s assumptions involve the RIA channel starting at 50% adoption in Year 1 and reaching 100% in Year 3. For broker-dealers and banks, they assume a more gradual adoption, beginning at 25% in Year 1 and steadily increasing to 75% in Year 3. Based on these assumptions, they estimate that the addressable market size for a US Bitcoin ETF would be approximately $14 trillion in Year 1 following its launch, increasing to approximately $26 trillion in Year 2, and reaching $39 trillion in Year 3.

To estimate inflows into Bitcoin ETFs, they consider that Bitcoin is adopted by 10% of the total available assets in each wealth channel, with an average allocation of 1%. Based on these market size estimates, they project inflows of approximately $14 billion into a Bitcoin ETF in the first year after its launch, with this figure increasing to approximately $27 billion in the second year and $39 billion in the third year following the ETF’s launch.

Amid the recent developments, BlackRock moved its iShares Bitcoin ETF filing to the DTCC platform. At the same time, the US court has asked the SEC to review Grayscale’s spot Bitcoin ETF filing.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

✓ Share: