Bitcoin (BTC) price is finally embracing support above $30,000 while bulls reach out for the yearly high at $31,000. The bellwether cryptocurrency has since early last week sustained an uptrend amid heated discussions surrounding the much-anticipated approval of BTC spot exchange-traded funds (ETFs) in the US.

Investors have come to appreciate the fake news that rocked the crypto space about the Securities and Exchange Commission (SEC) greenlighting BlackRock’s Bitcoin spot ETF proposal.

The fake news saw investors, especially retail rush to increase exposure to BTC which created momentum for the ongoing rally above $30,000. Up 2.6% in the last 24 hours, Bitcoin price is trading at $30,664, according to live market updates by CoinGape.

What Does A Spot BTC ETF Approval Mean For Bitcoin Price?

Bitcoin price has climbed considerably and is almost hitting its yearly high of $31,000 riding on momentum created by fake news about the approval of a spot ETF. Hence, the actual approval could invalidate all bearish sentiments and act as the springboard for the early stages of the bull market ahead of the 2024 halving.

A BTC spot ETF would open an influx of money from traditional investors, who prefer to buy shares of the product through a conventional stockbroker, thus avoiding the process of purchasing the digital asset directly on exchanges and subsequently the complexities associated with storing the coins in crypto wallets.

The approval would also validate Bitcoin as a mature asset—a status that crypto enthusiasts have long been waiting for. It is the expected influx of money from institutional investors in the traditional market that will act as the catalyst for a massive rally and coupled with the halving, they could usher in the 2024/2025 bull run.

A research report by JP Morgan released last Wednesday speculated that multiple spot ETFs would be approved, especially after the SEC decided not to appeal a recent court ruling in the Grayscale case.

Grayscale is the largest digital asset manager and operates the Grayscale Bitcoin Trust (GBTC), which it had sought to convert into a spot ETF. According to the report, the exact timing of the approval is uncertain but could happen within months.

Can Bitcoin Price Invalidate The Bearish Fractal?

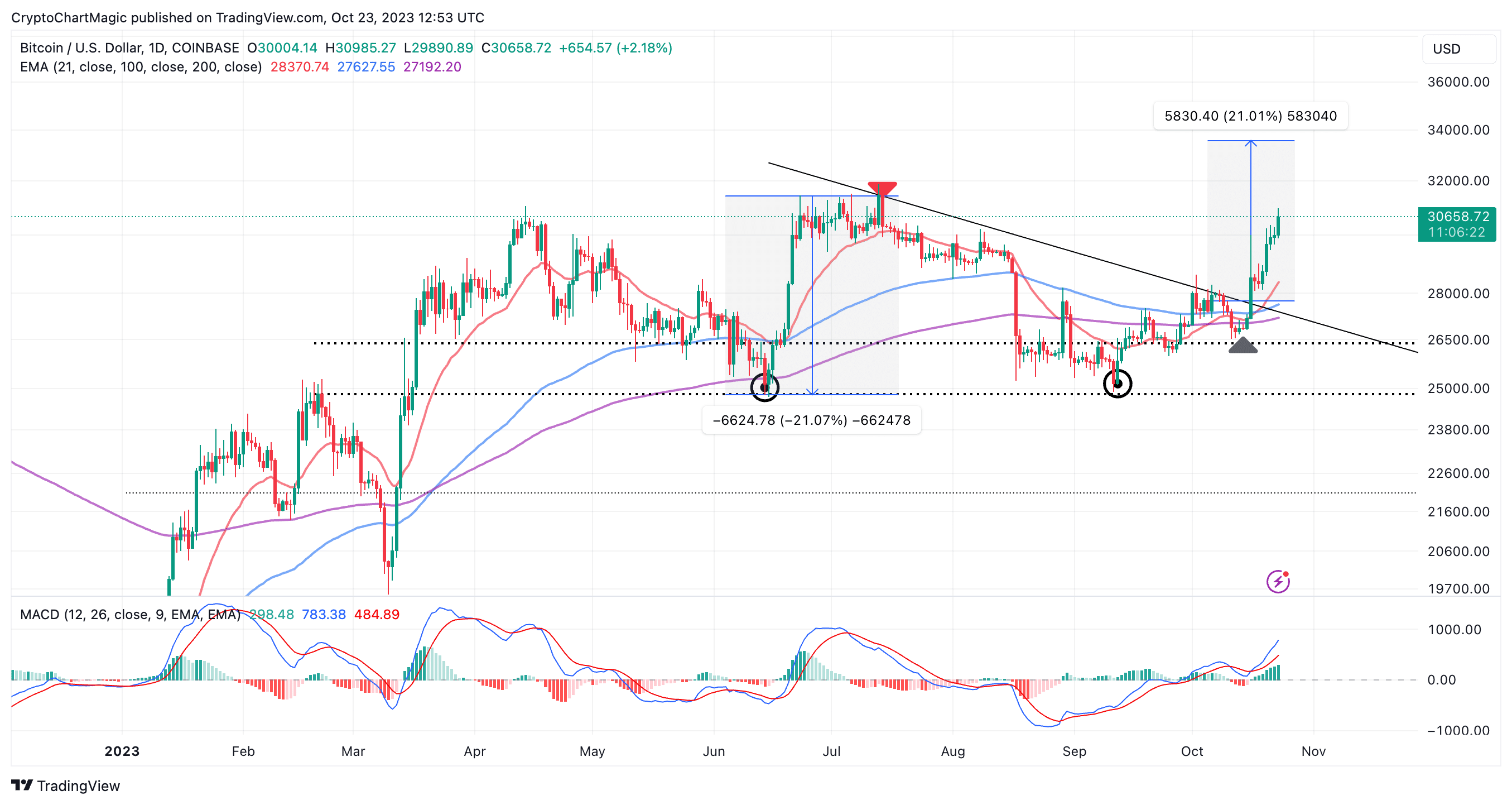

Bitcoin price is trading above a key bullish pattern — the double-bottom illustrated on the chart below. The path with the least resistance has since the breakout last week sustained to the upside, with BTC likely to clear resistance at $31,000 (yearly highs) for gains to $33,577.

Traders backing the uptrend could also be reading from the Moving Average Convergence Divergence (MACD) indicator, which sent a buy signal last Monday, October 16.

The bullish outlook is also validated by a golden cross pattern formed when the 21-day Exponential Moving Average (EMA) (red) crossed above the longer-term 100-day EMA (blue).

According to technical insight shared by analyst and trader Rekt Capital, “A clean break of the ~$31,000 highs is the final step to fully invalidating the Bearish Bitcoin Fractal.”

A clean break of the ~$31,000 highs is the final step to fully invalidating the Bearish Bitcoin Fractal$BTC #Crypto #Bitcoin pic.twitter.com/gT5IXSoSQG

— Rekt Capital (@rektcapital) October 23, 2023

In another post on X (Twitter), Rent Capital shared what he termed as “the Bearish Fractal invalidation criteria” but it is worth mentioning that a pullback below $30,000 is still on the cards, especially if resistance at $31,000 fails to budge.

At Range High resistance after breaking its multi-month Lower High

Reclaim red as support and/or Weekly Close beyond would likely confirm a breakout beyond the Range High

Until then, there is scope for a pullback into the high ~$27k for a retest$BTC #Crypto #Bitcoin pic.twitter.com/UHHMxBloTC

— Rekt Capital (@rektcapital) October 23, 2023

For now, bulls have the upper hand and are focused on pushing for gains above $31,000. A break and hold above this crucial level could validate the rally and open the door for the double-top pattern’s breakout target at $33,577 and subsequently above $35,000.

Related Articles

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

✓ Share: