Ethereum price is once again dealing with immense selling pressure while bulls move swiftly to defend support at $1,550. The hype around the approval of a bunch of Ether futures ETFs early last week propelled ETH to $1,750 but a weak crypto market structure coupled with profit-taking among investors cut short the recovery, leading to a sharp dive.

The largest smart contracts token although barely unchanged over the last 24 hours, is down 4.6% in a week to trade at $1,557 on Thursday. Approximately $7.5 billion in trading volume has come in during the same period while Ether’s market capitalization holds at $187 billion.

Ethereum Cedes Ground As Bitcoin Gains

Ethereum is ceding ground to the largest cryptocurrency, Bitcoin as investors seek exposure to the most popular digital asset amid the ongoing geopolitical tensions caused by the war between Israel and Hamas.

Since June, Ethereum’s market value has shrunk by 18% while Bitcoin lost around half of the same amount in the period to $522 billion. In the last seven days, market value decreased by 4.6% compared to Bitcoin’s 2.9% drop to $26,792.

This downward trend has led to a drop in Ethereum’s percentage of the total market capitalization to 17.9% from approximately 18.4% at the beginning of 2023. According to market data aggregated by CoinMarketCap, Bitcoin has come up stronger with its market value rising from 40% at the beginning of the year to 50%.

According to Bloomberg, the Ethereum network has suffered significant setbacks in the last few weeks, with network activity and gas fees dwindling. At the same time, the token’s supply has been on an upward trajectory following months of deflation.

Investors are also choosing Bitcoin over Ethereum as the war in the Middle East rages on. Ethereum has increased by 32% this year, slightly less than half of Bitcoin’s 66% growth.

“In fact, Ether has been massively underperforming the broad market since the Merge, with both the ETH/BTC price and volume ratio trending downwards over the past year,” research firm Kaiko said in a report. “Ether’s underperformance is likely due to the ongoing impact of the bear market, which historically has seen traders turn to Bitcoin.”

Ethereum Price On The Verge of A Bigger Dip

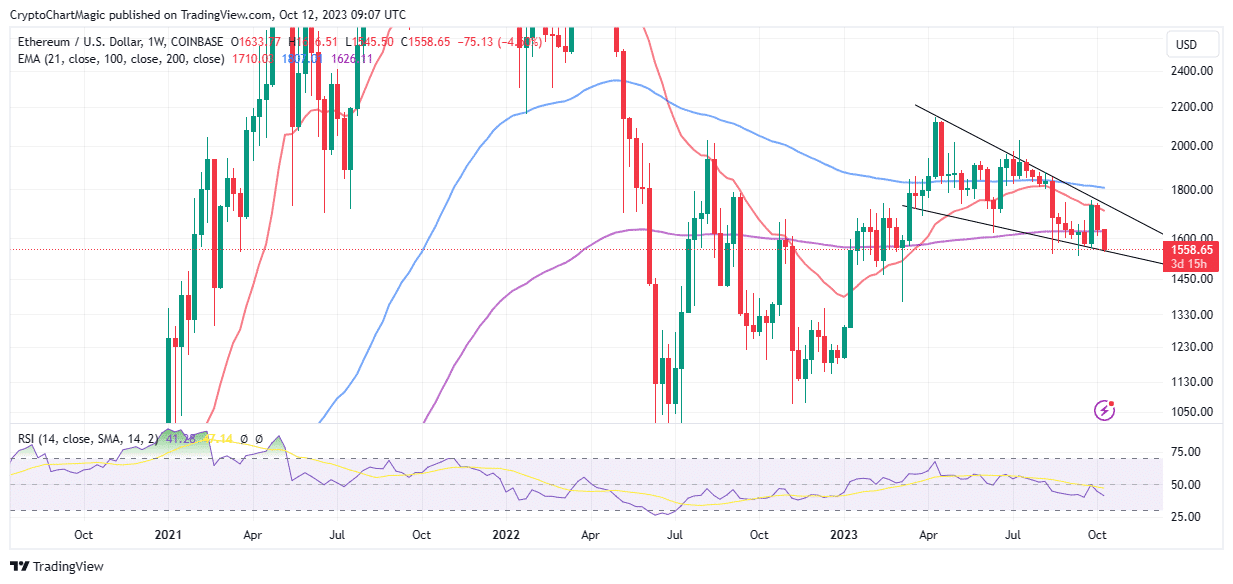

Ethereum price is holding below all the bull market moving average indicators including the 21-week Exponential Moving Average (EMA), the 100-week EMA, and the 200-week EMA.

The Relative Strength Index (RSI) reinforces the bearish outlook as the indicator drops below the midline (50) heading toward the overbought region (below 30).

Losing support at $1,550 would mean abandoning a potential trend reversal due to the formation of a falling wedge pattern on the weekly chart. The next possible support area from here is the buyer congestion at $1,450 but traders cannot rule out extended losses to $1,230 and $1,050, respectively.

An immediate recovery would be possible if bulls stand their ground at $1,550 and push to reclaim higher support at $1,600. This move would be enough to call investors back with the anticipation of a falling wedge pattern breakout targeting $1,800 and highs above $2,000.

Related Articles

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

✓ Share: